Tag: Responsible Finance

SP Fund round 3 in numbers

[divider] [divider] In October 2015, we launched the third round of the SP Fund (thanks to continued support from the Ford Foundation). The aim of this latest round is to b

Read more ...

Edukacja Finansowa w Polsce

[divider] [divider] Od 2003 r., w MFC zrealizowaliśmy ponad 50 projektów w 22 krajach. Projekty realizowane w Polsce są naszym laboratorium - ich wynikami dzielimy

Read more ...

Increasing Access to Finance for Rural Population in Belarus

Funder: USAID Partner: Republican Microfinance Center [divider] Financial services can be a lifeline to low-income peop

Read more ...

SP Fund opportunities for MFIs and networks

[divider] The SP Fund team is pleased to announce a second call for proposals for national microfinance associations that are interested in developing SP country reports. Partner

Read more ...

Social Performance Fund

[divider] Funder: Ford Foundation Partner: CERISE [divider] The Project Goal The Social Performance Fund promotes the broad adoption of the Universal Standards

Read more ...

My Home, My Responsibility

[divider] [divider] [divider] Funder: The project is supported by Obywatele dla Demokracji Program, finansed by EOG grants Partners: Habitat for Humanity Poland; Młodzie�

Read more ...

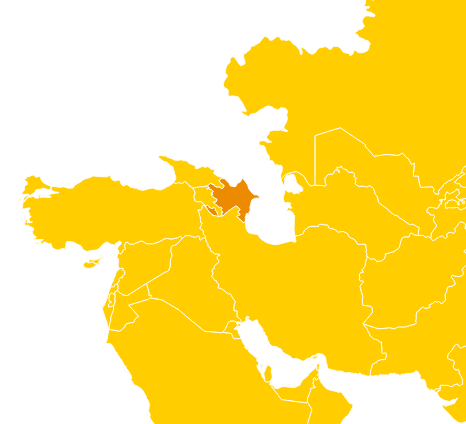

Promoting Women’s Entrepreneurship in Rural Azerbaijan

[divider] [divider] [divider]Funder: European Union Partner: Azerbaijan Microfinance Association (AMFA)[divider]We’re boosting women’s entrepreneurship in rural Az

Read more ...

Client Protection

[divider] The industry's growing concern around client protection is an effort to ensure fair, responsible and transparent services for clients. MFC primarily goal is to be indus

Read more ...

Social Performance Management (SPM)

[divider] Established in 1999, our global SPM program works with networks and MFIs on assessment and capacity building projects in order to develop systems and improve practice

Read more ...

Learn more about SPM

[divider] The microfinance industry is in a period of fast growth, both in terms of complexity, but also competition. In this environment, achieving and staying in tune with the m

Read more ...

Kosovo: Study on the risk of over-indebtedness

[divider] This study sought to understand whether there is a problem of (over-)indebtedness among microcredit clients in Kosovo. Through analyzing credit bureau data and conduct

Read more ...

Azerbaijan: Study on the risk of over-indebtedness of microcredit clients

[divider] This study on the risk of over-indebtedness in the ECA region was carried out in partnership with the Azerbaijan Micro Finance Association (AMFA). The objectives were t

Read more ...

Over-indebtedness of microfinance clients

[divider]Since 2008, MFC has studied drivers and deterrents of client over-indebtedness through annual MFI mapping studies and targeted country studies Our work reveals worrying t

Read more ...