Tag: Financial Inclusion

Implementing Financial Health: Creating Mutual Success for Financial Service Providers and Clients – Research Digest #3

By Max Niño-Zarazua, Aurélie Larquemin and Davide Castellani in collaboration with the European Microfinance Platform (e-MFP) ‘From Research to Practice and Back Again’ Actio

Read more ...

FINANCIAL INCLUSION COMPASS 2024

The Financial Inclusion Compass 2024 is the seventh in a series to collate sector opinions on emerging short, medium, and long-term trends in the financial inclusion sector.

Read more ...

Celebrating the Resounding Success of the 26th MFC Annual Conference Through Remarkable Images

The Microfinance Centre (MFC) is proud to announce the resounding success of the 26th MFC Annual Conference Embracing Diversity for Inclusive Finance. Held on May 14-15, 2024,

Read more ...

Financial Inclusion Compass 2023

e-MFP's Financial Inclusion Compass 2023 is the sixth annual survey of financial inclusion stakeholders to better understand perspectives on current trends, future priority area

Read more ...

Setting up financial instruments supporting migrant integration.

Practical guide part 1This fi-compass practical guide aims to assist Asylum, Migration, and Integration Fund (AMIF) Managing Authorities and other stakeholders as they begin explor

Read more ...

The Missing Entrepreneurs 2023

Policies for Inclusive Entrepreneurship and Self-EmploymentThe Missing Entrepreneurs 2023 is the seventh edition in a series of biennial reports examining how government policies c

Read more ...

Transform Together Fund (TTF) – Call for Evaluators

MFC and Cerise+SPTF are launching a call for external experts to evaluate applications submitted under the Social Innovations for Fair Green and Digital Transition project funded b

Read more ...

Meet the new MFC Member – Crimson Finance Fund Albania

We are more than happy to welcome and introduce our new Member, Crimson Finance Fund Albania!CFFA’s mission is to increase the access to finance for micro and small enterprises i

Read more ...

Meet the new MFC Member – Kamurj Universal Credit Organization CJSC

We are more than happy to welcome and introduce our new member - Kamurj Universal Credit Organization CJSC!Kamurj Universal Credit Organization CJSC stands as a leading microfinanc

Read more ...

Meet the new MFC Member – AFIN

We are proud and happy to announce that MFC is growing! Let’s introduce and welcome our new Member – AFIN!AFIN – ALTERNATIVE FINANCING IFN SA is the first non-bank financial

Read more ...

Meet the new MFC Member – AccessBank

We are proud and happy to announce that AccessBank has become a Member of MFC!Established in 2002, AccessBank Azerbaijan is a leading financial institution in microfinancing in the

Read more ...

Fairness in Algorithmic Decision Systems: A Microfinance Perspective

This Working Paper is the first paper resulting from a research project on "Strengthening Financial Inclusion through Digitalization: (SFIDE). The project aims to investigate the p

Read more ...

BUILDING A BRIDGE BETWEEN FINANCIAL EDUCATION AND FINANCIAL HEALTH

A publication of the ‘From Research to Practice and Back Again’ Action Group (AG) focuses on understanding the relationship between financial education (FE) and financial hea

Read more ...

Read MFC’s post-conference brief

The 25th MFC Annual Conference: Thriving Together. Silver Jubilee took place on 24-25 May in Budva, Montenegro. It was a very special occasion for MFC as the conference embarked th

Read more ...

Meet the new MFC Member – HES FinTech

We’re delighted to welcome HES FinTech as a new member of the Microfinance Centre!HES FinTech mission is to empower proactive entrepreneurs and leaders in the financial services

Read more ...

The Way to Business. Program for Ukrainian women in Poland

The MFC is delighted to announce the program in Poland on supporting Ukrainian entrepreneurial female displaced by the war in Ukraine. With the support provided by JP Morgan Chase

Read more ...

Meet the new MFC Member – The Yelo Bank

We’re delighted to welcome the Yelo Bank as a new member of the Microfinance Centre! Yelo Bank OJSC is a commercial bank in Azerbaijan with the focus on MSME and retail

Read more ...

Financial Inclusion that Works for Women: Lessons and best practices from the European Microfinance Award 2022

Financial Inclusion that Works for Women opens with a tour of a complex and emerging landscape of gender mainstreaming - a short history of microfinance for women, the demand and

Read more ...

Green Inclusive Finance: A Framework for Understanding How Financial Services Can Help Low-Income and Vulnerable People Respond to Climate Change

As climate change-induced events increase in frequency, unpredictability, and severity, the people most impacted by such events are those least responsible for historic carbon emis

Read more ...

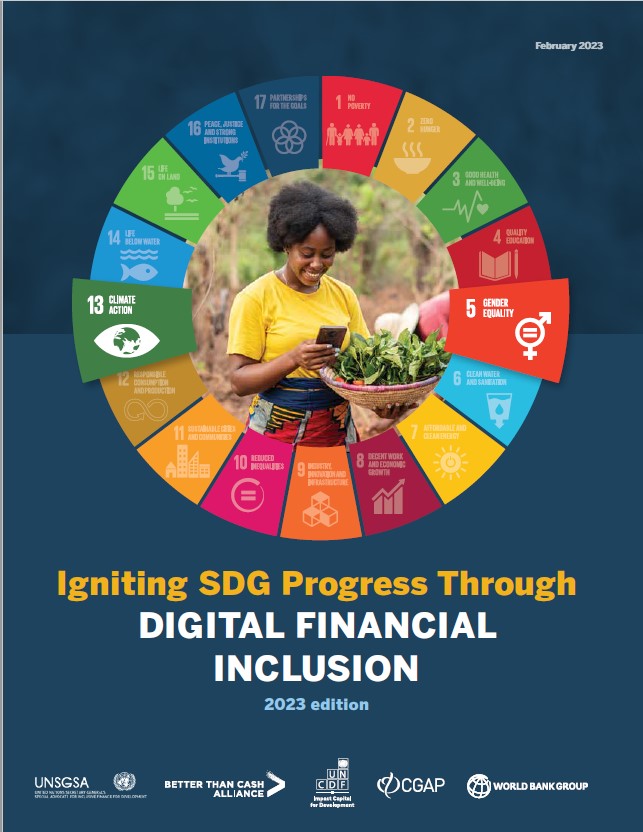

Igniting SDG Progress Through Digital Financial Inclusion (2023 edition)

Digital financial services offer real hope to help the world get back on track from the severe negative impacts from COVID-19.Building on the success of the 2018 edition, this new

Read more ...