Category:

27th MFC Annual Conference Through Highlight Video, Remarkable Images and Media Coverage

27th MFC Annual Conference took place in the historic city of Tbilisi, Georgia, from 27 to 29 May 2025. With [...]

Read more ...

Thank you for being part of the 27th MFC Annual Conference!

Thank you for joining us in Tbilisi for the 27th MFC Annual Conference – Shifts, Shocks and Solutions: Microfinance in [...]

Read more ...

Summary: Borrow Wisely and Microfinance for Youth Entrepreneurs Campaigns 2024

In 2024, the Microfinance Centre conducted two key campaigns: Borrow Wisely and Microfinance for Youth Entrepreneurs. Borrow Wisely, held from [...]

Read more ...

Discover the Key Social Finance Trends of 2024

[...]

Read more ...

Let’s make 2025 more innovative, diverse, and greener!

[...]

Read more ...

Happy Holiday Season

[...]

Read more ...

Thank you for Social Finance Vibe 2024

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily [...]

Read more ...

Microfinance for Youth Entrepreneurship Campaign 2024

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily [...]

Read more ...

Borrow Wisely Campaign 2024

[...]

Read more ...

Celebrating the Resounding Success of the 26th MFC Annual Conference Through Remarkable Images

[...]

Read more ...

Watch SIFTA Webinar: AI powered solutions for SEFPs – Responsible AI, Machine Learning and Practical Use Cases for Microfinance and Social Finance Institutions

this exclusive SIFTA webinar and discover how responsible AI can revolutionize your social finance institution! Here’s what you’ll gain: Transformative [...]

Read more ...

Watch SIFTA Webinar: How to analyze social enterprises – Demystifying Financing Social Enterprise: Analysis, Risks & Rewards

style=”text-align: justify;”>Social enterprises play an increasingly important role in the European economy. By linking economic activity with social impact, these [...]

Read more ...

Watch SIFTA Webinar: How to give employees constructive feedback

style=”text-align: justify;”>Feedback, especially constructive feedback, is something that should not be feared, on the contrary, can be treated as a [...]

Read more ...

FEBEA and MFC Join Forces to Strengthen Microfinance and Ethical Finance in Europe

Microfinance Centre (MFC) and European Federation of Ethical and Alternative Banks ( About Microfinance Centre (MFC): A social finance [...]

Read more ...

Setting up financial instruments supporting migrant integration.

Practical guide part 1 This fi-compass practical guide aims to assist Asylum, Migration, and Integration Fund (AMIF) Managing Authorities and [...]

Read more ...

Watch Webinar: MFC and Tech to the Rescue

you may already know, MFC and Tech To The Rescue (TTTR) – a global platform that connects nonprofits with tech companies [...]

Read more ...

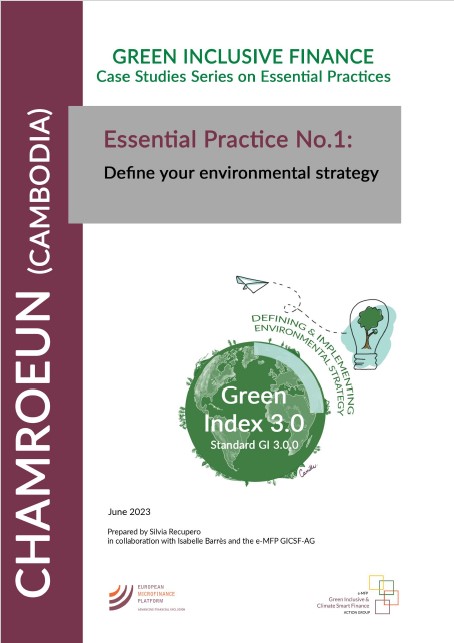

Green Index 3.0: case studies for each Essential Practice

Read the case studies which illustrate how the Green Index framework can be useful to the institutions looking for learning [...]

Read more ...

SIFTA Mid-Year Highlights: A Strong Start to 2025

[...]

Read more ...

2024 marked a successful year for MFC – read the annual report 2024

DOWNLOAD & [...]

Read more ...

Empowering Inclusion: 7 Social Innovation Cases

[...]

Read more ...

Get Ready for Social Finance Vibe 2025 – The Benchmark Online Conference

[...]

Read more ...

Read the latest case study and learn how Confeserfidi empower green entrepreneurs in Sicily

In Sicily, where microentrepreneurs often struggle with financial, social, and digital barriers—especially women, migrants, and youth—Confeserfidi is paving the way [...]

Read more ...

The Microfinance Centre joins the call for a stronger European Social Fund+

[...]

Read more ...

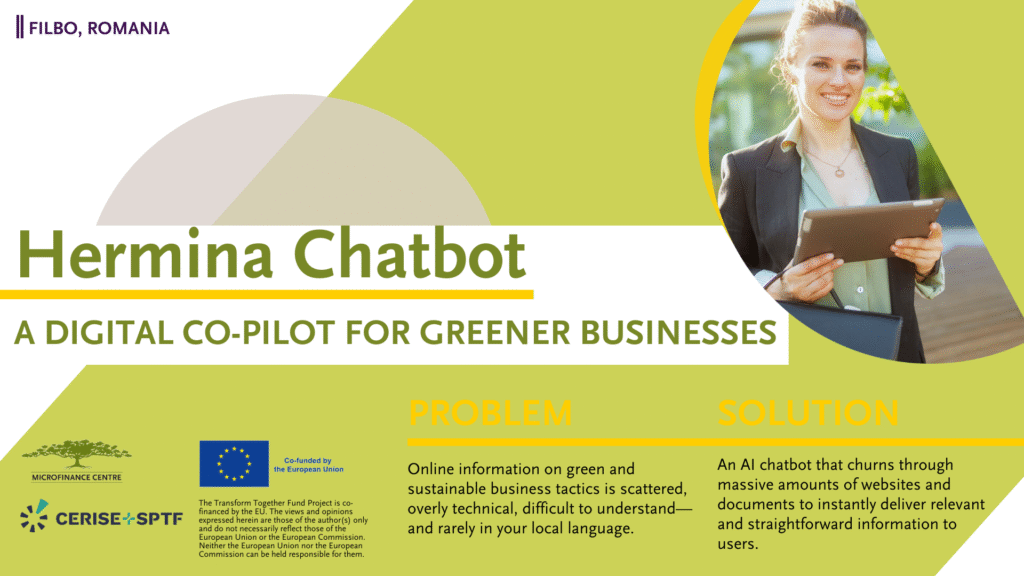

How to help small businesses go green? Hermina, FILBO’s AI Sustainability Assistant, knows the answer

Why Hermina? Client surveys conducted by OMRO revealed a consistent theme: entrepreneurs were open to sustainable practices, but lacked clarity [...]

Read more ...

Let’s Shape the Future of Microfinance in Europe. Join us in the EU Code of Good Conduct Survey

[...]

Read more ...

Insurance and Risk Management Tools for Agriculture in the EU

The report takes stocks of the forms of support currently in place for agriculture insurance schemes and other climate adaptation de-risking schemes across EU Member [...]

Read more ...

Join the webinar: Digital self-service platforms for vulnerable clients. Improving green and digital skills

Transform Together Fund Project, co-financed by the ESF+ Programme. Throughout the last 15 months, the organizations were working on the [...]

Read more ...

Join the webinar: Improving green and digital skills of clients in rural areas through direct and online engagement

Transform Together Fund Project, co-financed by the ESF+ Programme. 3Bank (Serbia) will share their experience on how they enable digital [...]

Read more ...

EmpowerHer: check how to strengthen the women entrepreneurs digitally

Meet Microlab and their project developed under the Transform Together Fund! Over the past 15 months, Microlab has been working [...]

Read more ...

Recap of Novalend Peer-to-Peer Visit to Klear Lending under SIFTA

NovaLend (Poland) met [...]

Read more ...

BCR Social Finance Welcomes Bielskie Centrum Przedsiębiorczości (BCP)

[...]

Read more ...

Register for webinars: 9 Practical Solutions to Boost Green & Digital Skills in Microfinance

Join Microfinance Centre and Cerise+SPTF for a hands-on webinar series under the Transform Together Fund, where practitioners will showcase the [...]

Read more ...

Why ESG factors are important for the business sector, particularly for credit unions?

[...]

Read more ...

How to lead and connect the talents and needs of multiple generations? Join our SIFTA webinar on managing a multi-generational team

In today’s dynamic financial landscape, successful leadership requires more than technical expertise – it demands the ability to understand and [...]

Read more ...

SIFTA | Webinar on Beyond Compliance: Operationalizing ESG for a Sustainable Competitive Edge

Why Attend? With increasing expectations from regulators, investors, and clients, ESG has evolved from a reporting obligation into a critical [...]

Read more ...Projects

Welcome to our Projects Page, your gateway to exploring impactful initiatives in digitalization, social economy, responsible finance, green microfinance, and other projects. Immerse yourself in stories of innovation that collectively shape the future of microfinance. Discover a diverse range of projects contributing to positive change and progress.