Tag: Responsible Finance

Refugee Finance in times of uncertainty: mitigating risks and identifying opportunities

24 May and 26 April 2022

INTRODUCTIONThe crisis in Ukraine continues to impact financial markets across the world. As financial service providers begin to come to terms with the new reali

Read more ...

Webinar on Innovation in BDS for farmers – ABA center and FED Invest case study

6 April 2022

IntroductionSharing the experience of the partnership of FED Invest, Japan International Cooperation Agency (JICA)-supported Project on Financial Inclusion of Albanian Smallholders

Read more ...

Enhancing Refugees’ Financial Inclusion

Project title: Enhancing refugees’ financial inclusion (access to microfinance and business development support) Project status: active Project duration:�

Read more ...

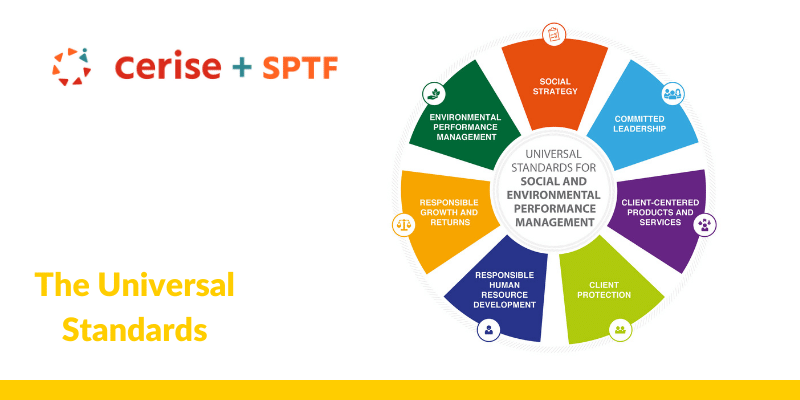

Updated edition of the Universal Standards

The Universal Standards for Social and Environmental Performance Management (“the Universal Standards”) is a comprehensive manual of best practices to help financial service pr

Read more ...

Borrow Wisely! Financial Education Campaign

What is Borrow Wisely! Campaign?The Borrow Wisely! promotes global client protection standards. This annual international campaign is led by the MFC and its partners. We work with

Read more ...

#2020BWC Champion – Microinvest from Moldova – Shares Impressions from the Campaign

MFC Member from Moldova, Microinvest, wants to share with you their BWC activities report. In 2020 Microinvest thanks to their great involvement, enormous work and creative appro

Read more ...

Borrow Wisely Campaign 2020 Presenting Its Results, 2021 Edition Inviting You to Join!

[article regularly updated] Last year’s BWC results are here for you to consult. The participants, assisted by MFC team, have done a tremendous job to adapt the Camp

Read more ...

#BorrowWisely is kicking off in TWO WEEKS!

Borrow Wisely Campaign is almost here – the 7th edition is starting on the very first day of October! This year the format will be modified due to the pandemic restrictions. But

Read more ...

EC: Respond to the Call for Proposals on Social Innovation – Establishing and Testing Integrated Interventions Aimed at Supporting People in (the Most) Vulnerable Situations – deadline 15 October

Under the European Program for Employment and Social Innovation (EaSI), the European Commission has published a call for proposals for financial support for initiatives rel

Read more ...

MFC is Part of An International Coalition to Protect Microfinance Institutions and Their Clients in the Covid-19 Crisis

At the initiative of Grameen Crédit Agricole Foundation, MFC with a group of microfinance lenders and key players in inclusive finance worked on a set of principles to better supp

Read more ...

WATCH the Webinar: How an MFI can act best during the time of the pandemic? Learn from the others’ practices & share yours!

MFC and EMN are jointly organizing a webinar aiming to help you cope with the pandemic effects - how to protect your Staff and Clients? - how to cope with pandemic effects on MFI's

Read more ...

COVID-19 Pandemic Announcement – MFC Working On-line to Support Members

Taking into account the current pandemic of coronavirus and the epidemic state introduced by Polish authorities, MFC Team is now working remotely. Any kind of activities planned in

Read more ...

EU Commission Announces Action Plan for Social Economy

The Commission presents a Communication on building a strong social Europe for just transitions. It sets out how social policy will help deliver on the challenges and opportunities

Read more ...

The Universal Standards for Social Performance Management – Where do we go from here?

[divider] The Microfinace Centre, the CERISE and the SPTF in cooperation with e-MFP Making Microfinance Responsible (MIR) Action Group have published brief "The Un

Read more ...

2017 Borrow Wisely Campaign Results

[divider] [divider] We are pleased to share with you the final evaluation results of our 2017 Borrow Wisely Campaign! The Borrow Wisely Campaign is an international in

Read more ...

Join fi-compass ESF Conference about Financial instruments

[divider] [divider] Second fi-compass ESF Conference Financial instruments funded by the European Social Fund – boosting social impact 8 – 9 March 2018, Brussels, Bel

Read more ...

Watch and listen again to recent Webinars!

[divider] Microfinance & Business start-ups: Review of the current practice in Europe https://www.youtube.com/watch?v=pT8iJWZGxZE [divider] Mikfrofinans Norge m

Read more ...

Albanian Microfinance: 25 Years in the Service of Free Entrepreneurship

[divider] [divider] The Albanian Microfinance Association (AMA) brings together the most consolidated Albanian MFIs with an outstanding loan portfolio of approximately USD 120 mi

Read more ...

SP Fund Partners/Grantees Publications

[divider] Social Performance Country Report developed by Union of Credit Organizations of Armenia (UCORA), 2016. The report includes information about SP policies, pra

Read more ...

#BWC2017 Join us! Borrow Wisely Campaign

[divider] In October 2017, the MFC and leading financial institutions from across the ECA region will launch the fourth annual Borrow Wisely Campaign. Our aim? To radically im

Read more ...