Tag: Over-indebtedness

Borrow Wisely Campaign 2020 Presenting Its Results, 2021 Edition Inviting You to Join!

[article regularly updated] Last year’s BWC results are here for you to consult. The participants, assisted by MFC team, have done a tremendous job to adapt the Camp

Read more ...

#BorrowWisely is kicking off in TWO WEEKS!

Borrow Wisely Campaign is almost here – the 7th edition is starting on the very first day of October! This year the format will be modified due to the pandemic restrictions. But

Read more ...

The 2018 Borrow Wisely Campaign is Over, but the Impact Goes on…

[divider] 'Are you kidding me? This is unbelievable! A financial institution that is taking care of me and my budget? From the bottom of my heart, thank you and MFC for this

Read more ...

Research results

[divider] Microfinance in Europe. Social Performance Management Report The Report presents current state of social performance practices of European microfinance se

Read more ...

Policy Papers 2009-2016

MFC Policy Paper No.5: Demystifying the role of microfinance in job creation The paper discusses the role of microfinance in job creation through self-employment and

Read more ...

MFC Barometer survey: Have your say!

[divider] [divider] Please take part in our annual barometer survey and let us know about your experience using EU programs and instruments, as well as about over-indebtedn

Read more ...

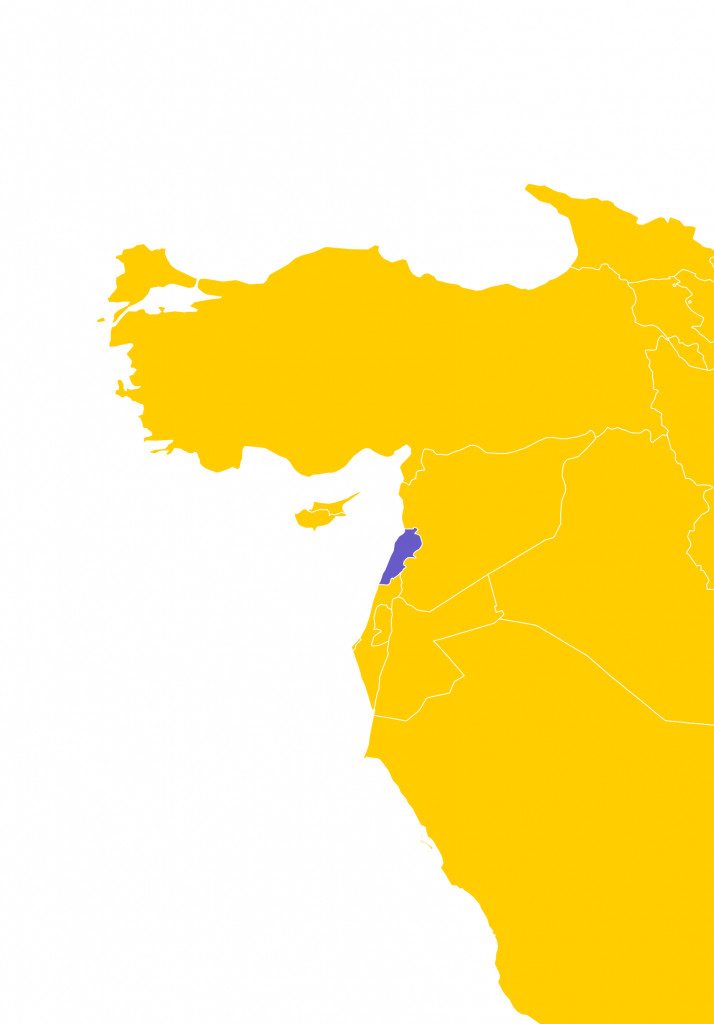

Are Microfinance Borrowers in Lebanon Over-Indebted?

The paper "Are Microfinance Borrowers in Lebanon Over-Indebted?" presents the results of the research study that aimed to provide empirical evidence that would confirm or refute

Read more ...

Over-indebtedness Trends in Europe – Issue No. 2

The European Quality of Life Survey (2016) shows the improving trend in the incidence of arrears on various types of dues among European households. Still, the utility bills are th

Read more ...

“Indicators to monitor over-indebtedness” working paper launched by the EFIN Working Group

[divider] [divider] The Working Paper "Indicators to monitor over-indebtedness" is a result of the work of the EFIN Working Group on Over-indebtedness coordinated by MFC. It p

Read more ...

Research Program

[divider]MFC undertakes quantitative and qualitative research studies in order to provide an insight into the drivers of customer behavior and market development We carry out ente

Read more ...

Access to Finance Barometer

As part of a multi-component project funded by European Commission, MFC is developing and testing methodology of Access to Finance Barometer that will provide insights into the cou

Read more ...

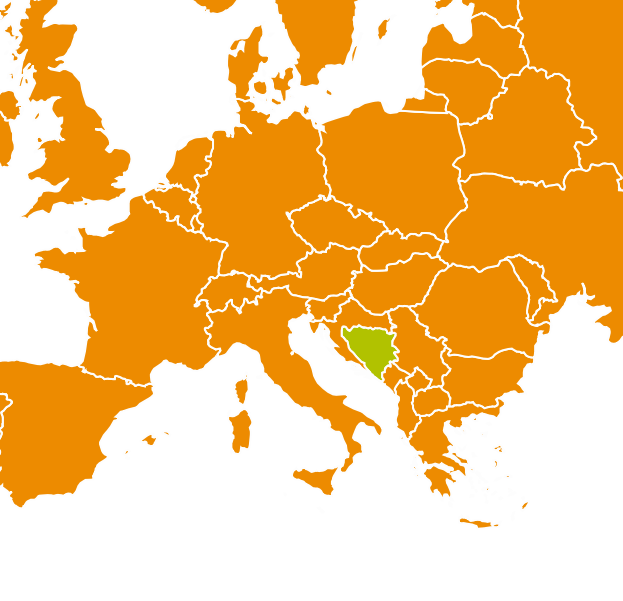

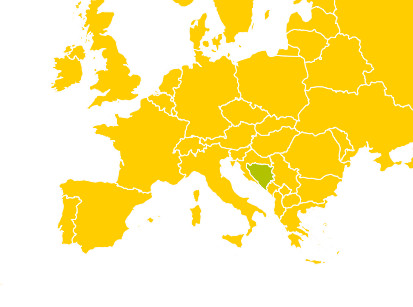

Bosnia and Herzegovina: Follow-up study on the risk of over-indebtedness of microcredit clients

[divider] This study focused on client over-indebtedness in Bosnia and Herzegovina, levels of which were the highest in the Central and Eastern Europe market. The study results

Read more ...

Bosnia and Herzegovina: Pilot study on access of low-income households to financial services

[divider] This study examined the application of customer protection principles, access to financial services and the risk of over-indebtedness among low-income clients in Bosnia

Read more ...

Kosovo: Study on the risk of over-indebtedness

[divider] This study sought to understand whether there is a problem of (over-)indebtedness among microcredit clients in Kosovo. Through analyzing credit bureau data and conduct

Read more ...

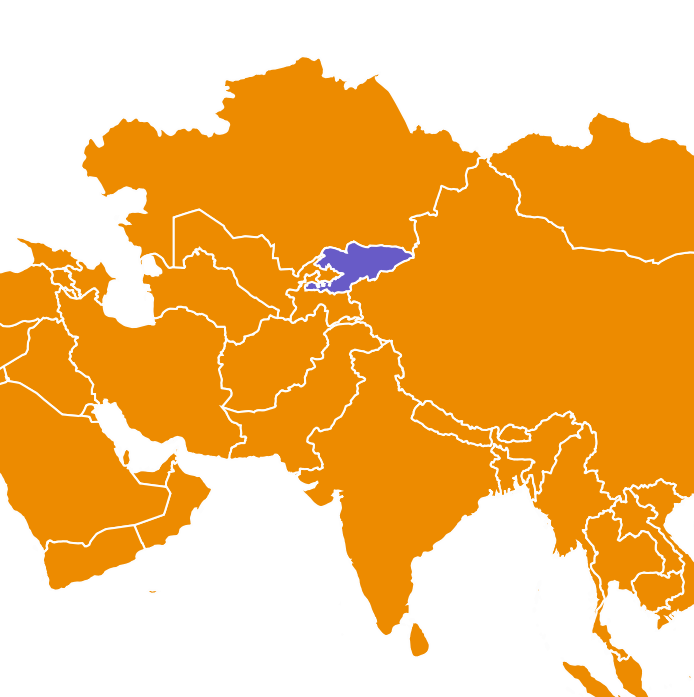

Kyrgyzstan: Research on indebtedness and repayment performance

[divider] In this study, MFC analyzed data from the CIB "Ishenim" credit bureau, which manages borrower information from around 50 financial institutions (banks and MFIs) in Kyr

Read more ...

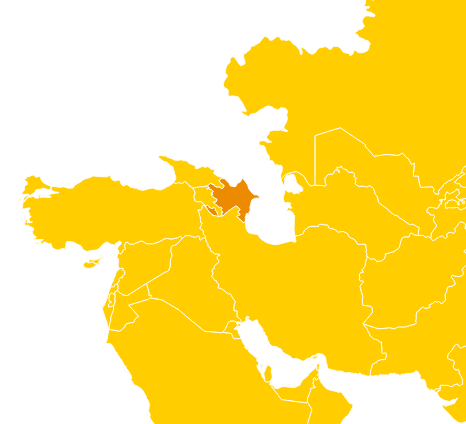

Azerbaijan: Study on the risk of over-indebtedness of microcredit clients

[divider] This study on the risk of over-indebtedness in the ECA region was carried out in partnership with the Azerbaijan Micro Finance Association (AMFA). The objectives were t

Read more ...

Bosnia and Herzegovina: Indebtedness Revisited: the Level of indebtedness of MSME Credit Customers and the Quality of Finance

[divider] This report analyses the level of indebtedness of MSME credit customers and the quality of finance in Bosnia and Herzegovina (BiH). The objectives of the follow-up stud

Read more ...

Lebanon: Measuring Indebtedness Levels of Low-Income Borrowers

[divider] The goal of the study was to measure indebtedness levels of active microcredit clients at individual and household level in Lebanon. For this purpose, the study aimed a

Read more ...

European Union: Measuring Over-indebtedness: Indicators, Data, Reporting

[divider] Project Dates: 1st January - 31 December 2014 Supported by European Commission MFC Policy paper: Debt, Borrowing and Over-indebtedness: A Country-Le

Read more ...

Over-indebtedness of microfinance clients

[divider]Since 2008, MFC has studied drivers and deterrents of client over-indebtedness through annual MFI mapping studies and targeted country studies Our work reveals worrying t

Read more ...