Past Projects

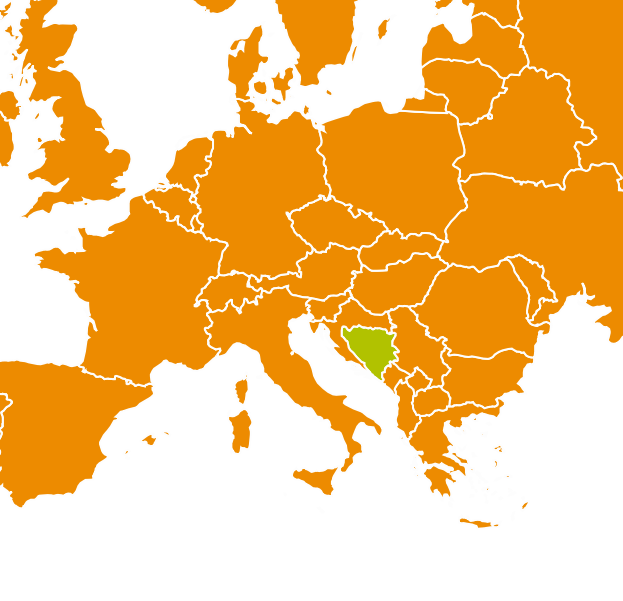

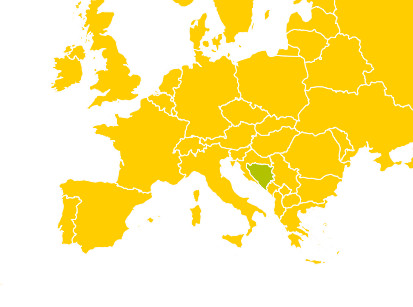

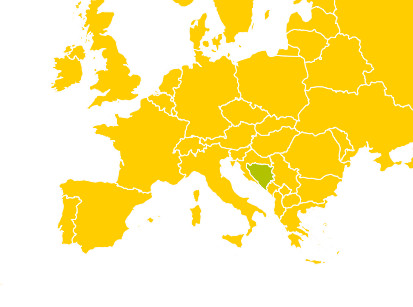

Bosnia and Herzegovina: Pilot study on access of low-income households to financial services

This study examined the application of customer protection principles, access to financial services and th

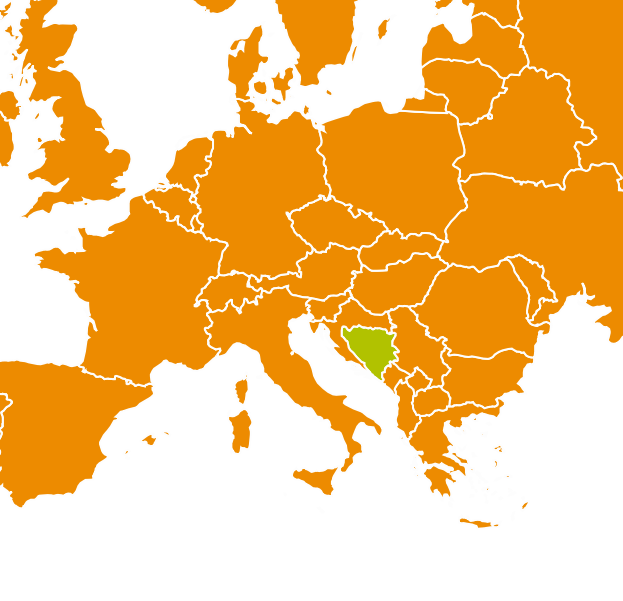

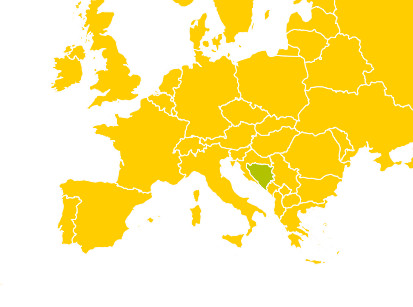

Kosovo: Study on the risk of over-indebtedness

This study sought to understand whether there is a problem of (over-)indebtedness among micro

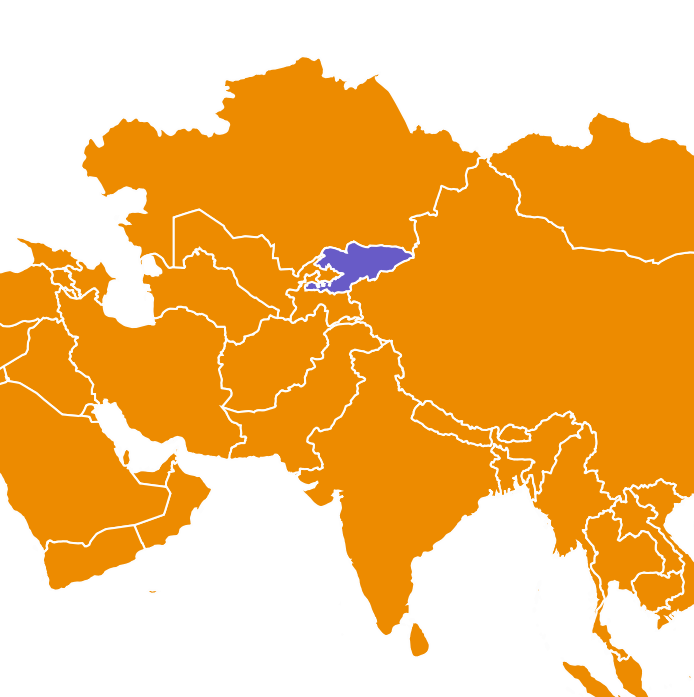

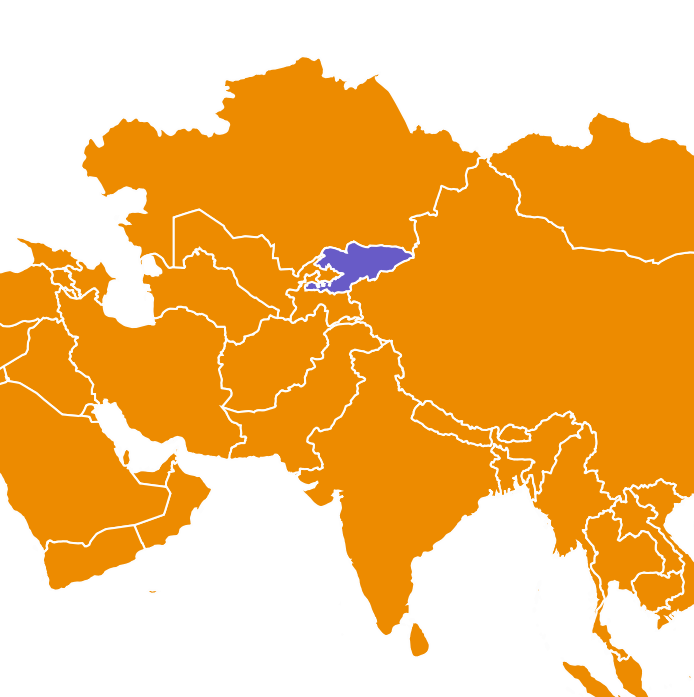

Kyrgyzstan: Research on indebtedness and repayment performance

In this study, MFC analyzed data from the CIB “Ishenim” credit bureau, which manages borrower information fr

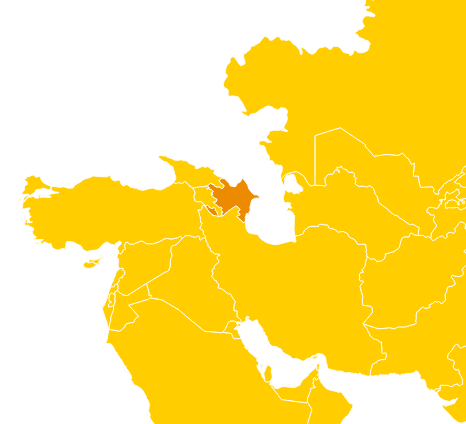

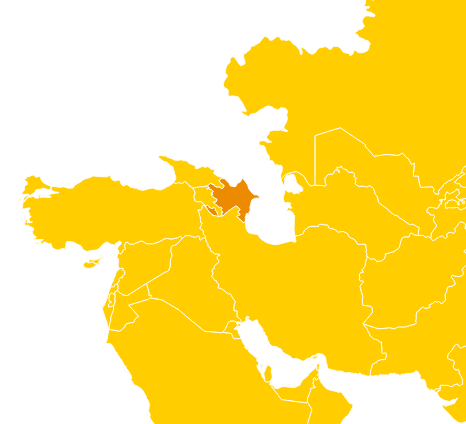

Azerbaijan: Study on the risk of over-indebtedness of microcredit clients

This study on the risk of over-indebtedness in the ECA region was carried out in partnership with the

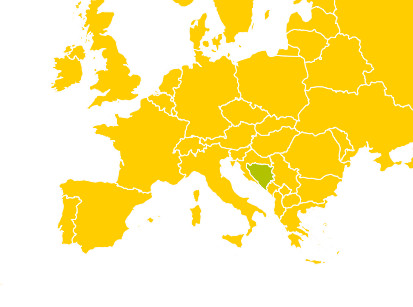

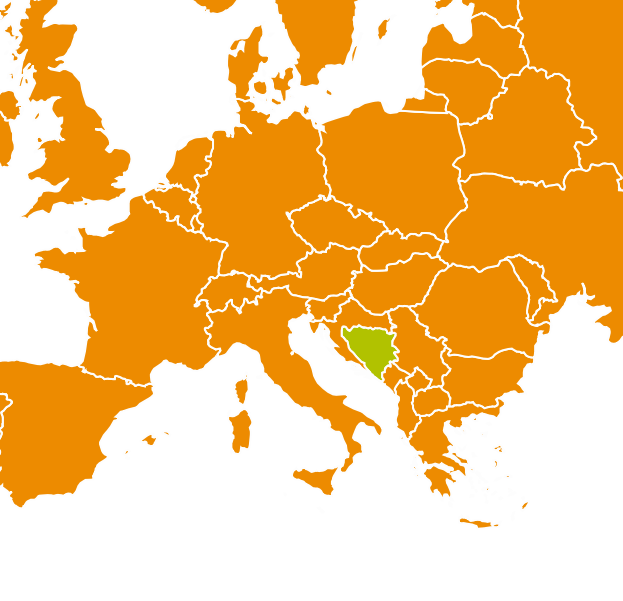

Bosnia and Herzegovina: Indebtedness Revisited: the Level of indebtedness of MSME Credit Customers and the Quality of Finance

This report analyses the level of indebtedness of MSME credit customers and the quality of fi

Bosnia and Herzegovina: Pilot study on access of low-income households to financial services

This study examined the application of customer protection principles, access to financial services and th

Kosovo: Study on the risk of over-indebtedness

This study sought to understand whether there is a problem of (over-)indebtedness among micro

Kyrgyzstan: Research on indebtedness and repayment performance

In this study, MFC analyzed data from the CIB “Ishenim” credit bureau, which manages borrower information fr

Azerbaijan: Study on the risk of over-indebtedness of microcredit clients

This study on the risk of over-indebtedness in the ECA region was carried out in partnership with the

Bosnia and Herzegovina: Indebtedness Revisited: the Level of indebtedness of MSME Credit Customers and the Quality of Finance

This report analyses the level of indebtedness of MSME credit customers and the quality of fi