Category: NEWS

The first semester of SIFTA activities was a success

[...]

Read more ...

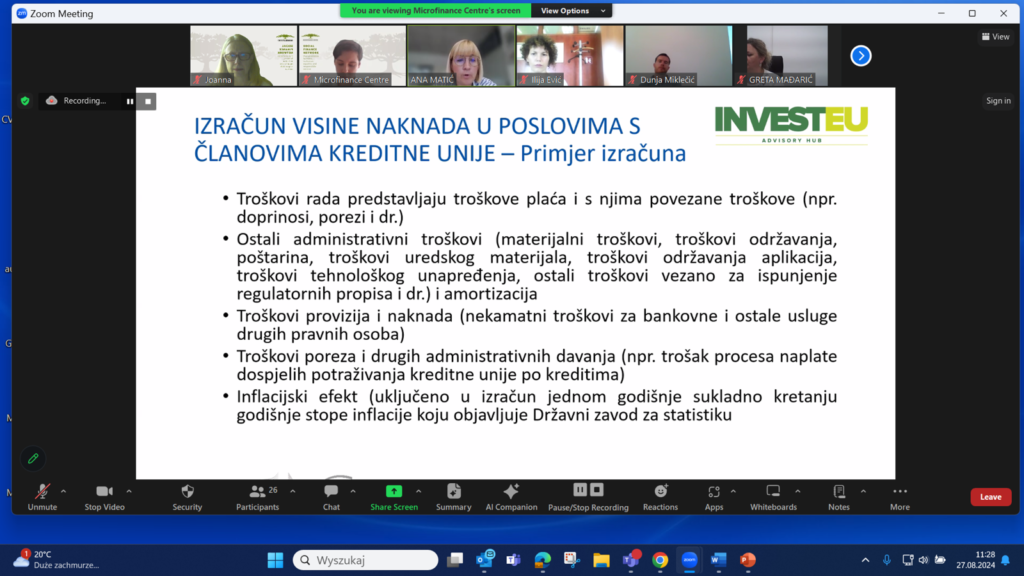

Successful SIFTA Webinar on Fee Methodologies for Croatian Credit Unions!

[...]

Read more ...

Fimple and PCES Join Forces

[...]

Read more ...

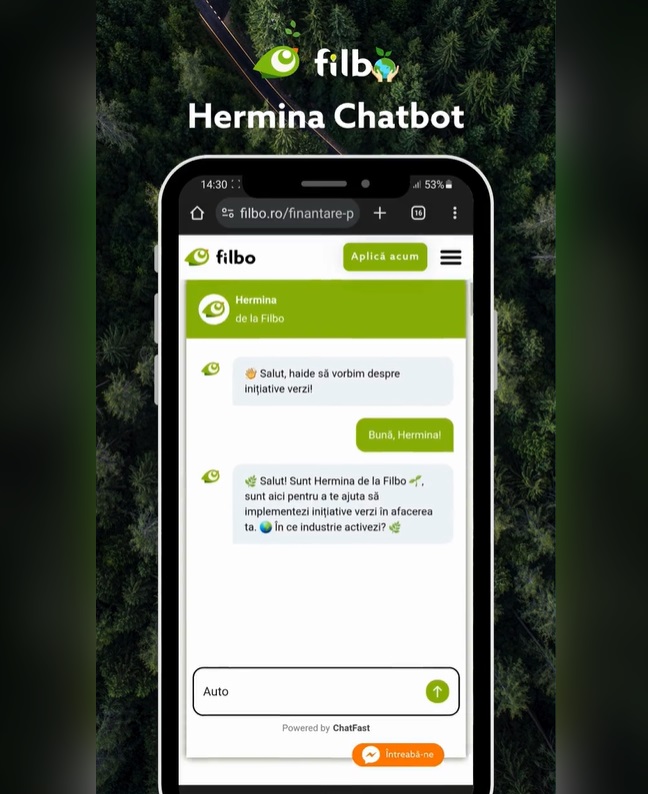

Meet Hermina

[...]

Read more ...

Welcome to Finbee – our new member

[...]

Read more ...

The potential for financial instruments supporting migrant integration

[...]

Read more ...

MFC has been re-elected as a member of the EU Commission’s expert group

We are thrilled to announce that the Microfinance Centre (MFC) has been re-elected as a member of the EU Commission’s [...]

Read more ...

Vitas Romania is celebrating its 30th Anniversary

[...]

Read more ...

Onsite Training with Flexidea

[...]

Read more ...

Two onsite tailored trainings under SIFTA Program

[...]

Read more ...

Join Microfinance for Youth Entrepreneurship and Borrow Wisely Campaigns 2024!

In October and November we’re going to run very exciting campaigns, and we invite you to join us in becoming [...]

Read more ...

MFC Members: Let’s Unite Our Marketing Powers!

[...]

Read more ...

AccessBank Receives the “Gender Equality Financing” Award

[...]

Read more ...

Connecting Microfinance and Social Enterprise

REGISTER *** Euclid Network represents over 50 social enterprise intermediaries across 30 European countries, collectively serving over 100,000 impact-driven organizations. [...]

Read more ...

MFC hosted three SIFTA trainings

[...]

Read more ...

MFC engages with Social Economy Stakeholders in Brussels

[...]

Read more ...

Joint Effort with EMN

[...]

Read more ...

Partnering with FEBEA

On April 11-12, we had the pleasure of hosting Daniel Sorrosal, Secretary General of FEBEA, at our Warsaw office. Our [...]

Read more ...

MFC and EMN Collaborate with DG EMPL on Key Microfinance Initiatives

[...]

Read more ...

Successful Peer-to-Peer Visit: Finbee Representatives Explore Polish MSME Finance Landscape

[...]

Read more ...Projects

Welcome to our Projects Page, your gateway to exploring impactful initiatives in digitalization, social economy, responsible finance, green microfinance, and other projects. Immerse yourself in stories of innovation that collectively shape the future of microfinance. Discover a diverse range of projects contributing to positive change and progress.