Microfinance Leaders at COP30: Channeling Climate Finance to People Who Need It Most

For years, Microfinance Centre has worked to channel green finance directly to local communities with support of MFIs and this November, we took that to the global stage at COP30 in Belém, Brazil.

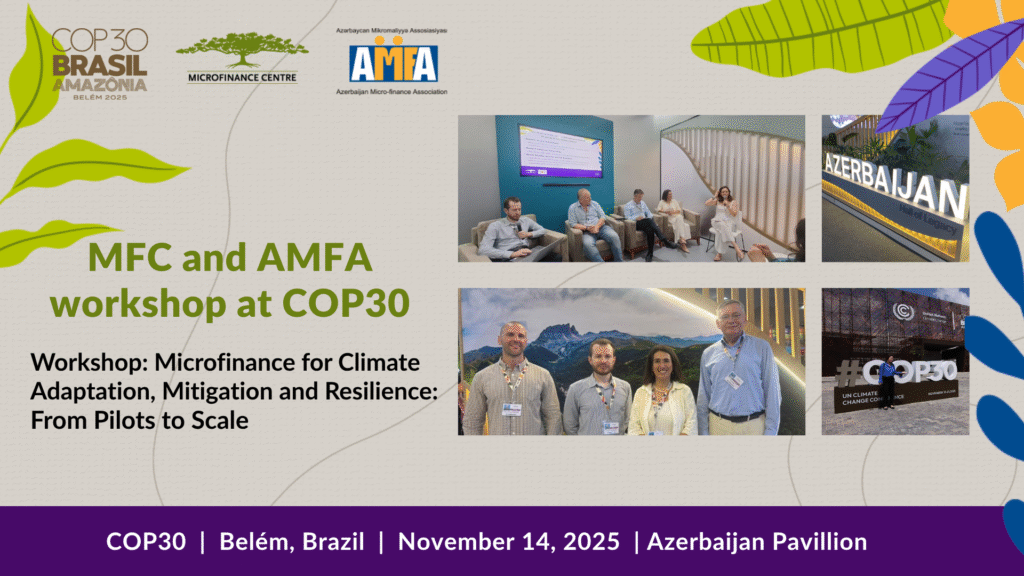

Together with the Azerbaijan Micro-Finance Association (AMFA), we brought together leading microfinance institutions, regulators, climate investors and global climate funds for a high-level workshop: Microfinance for Climate Adaptation, Mitigation and Resilience: From Pilots to Scale.

The goal? To spotlight an urgent reality: while global climate finance is growing, too little reaches vulnerable households, smallholders, and micro-entrepreneurs who need affordable solutions now.

Key insights from the workshop:

- Microfinance institutions (MFIs) are essential channels for delivering climate-resilient financial products.

- Successful models showcased from the ECA region included:

- Partner MFI (Bosnia & Herzegovina) – affordable energy-efficiency lending.

- FINCA Azerbaijan – hybrid agricultural loan and insurance for small farmers.

- FRW Poland – renewable energy and heating infrastructure loans for municipalities and social enterprises.

We concluded by presenting the COP30 Guiding Principles for Microfinance and Climate Adaptation, calling for:

- Directing climate finance to communities

- De-risking climate-adaptation lending

- Ensuring affordability

- Promoting locally led adaptation

- Transparent, accountable impact measurement

Learn more about the COP30 Guiding Principles: COP30 Guiding Principles

#COP30 #ClimateFinance #Microfinance #ClimateAction #GreenFinance #FinancialInclusion #Sustainability #ClimateAdaptation #Resilience #InclusiveFinance