Category: NEWS

Innovative Solutions for Sustainable Microfinance: Azerbaijan Microfinance Association’s Conference

[...]

Read more ...

New Leadership and Modern Organizational Culture in Generational Work

Who is a Servant Leader? How to overcome challenges arising from generational differences? Why do teams today seek inspiring guides [...]

Read more ...

Transform Together Fund (TTF) mid-term meeting in Warsaw

[...]

Read more ...

SIFTA Workshop “Market Opportunities for Credit Unions in Croatia”

[...]

Read more ...

NEW PAPER PUBLISHED! Supporting micro and small entrepreneurs and vulnerable households for a fair green transition

[...]

Read more ...

Central Asian Microfinance Summit in Samarkand

On September [...]

Read more ...

Life through soil!

FAER (Romania), a partner in the Transform Together Fund coordinated by MFC and Cerise+SPTF, has successfully completed phase 1 of [...]

Read more ...

Why do we communicate? What messages are we conveying?

[...]

Read more ...

MFC feedback within the mid-term review of the Digital Education Action Plan (DEAP)

[...]

Read more ...

Our joint efforts with EMN for DG EMPL are gaining momentum

[...]

Read more ...

Successful peer to peer visit under the SIFTA Program

[...]

Read more ...

MFC and Euclid Network Members Meet-Up

[...]

Read more ...

Empowering Women Entrepreneurs: Successful Completion of “The Way to Business” Program

The interviewees confirmed that decisions to start their own business in Poland were well-designed but not fast and easy, they [...]

Read more ...

Catalysing Impact: MFC & EN Member Meet-up

REGISTER Agenda Highlights: Opening Remarks: Welcome by Gerlinde Schmidt (EN) and introductions by Beata Biela (MFC) and Toby Gazeley (EN). [...]

Read more ...

The first semester of SIFTA activities was a success

[...]

Read more ...

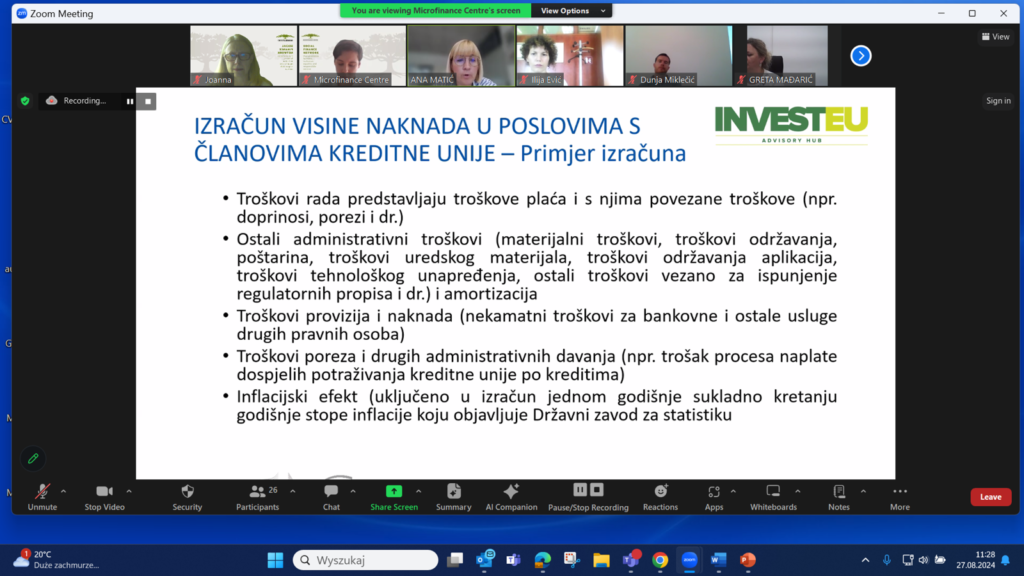

Successful SIFTA Webinar on Fee Methodologies for Croatian Credit Unions!

[...]

Read more ...

Fimple and PCES Join Forces

[...]

Read more ...

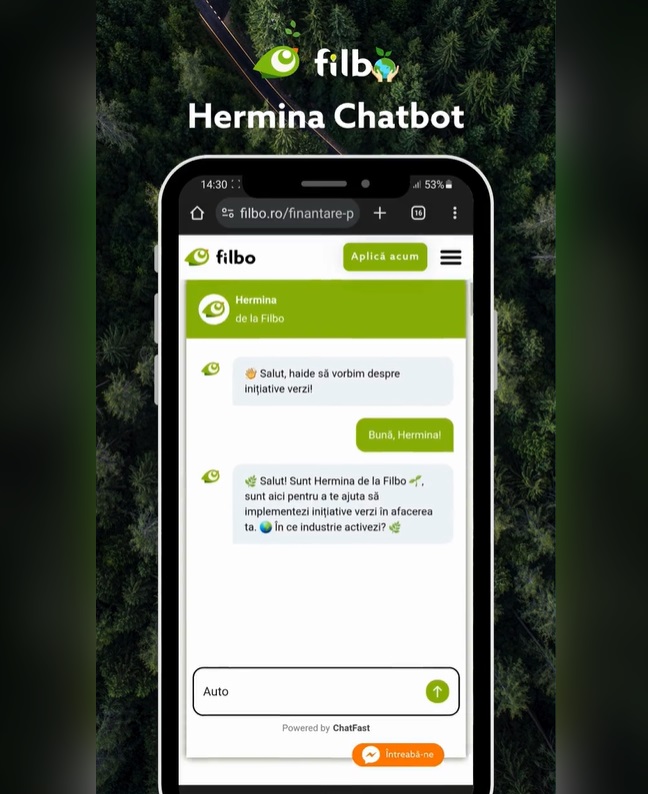

Meet Hermina

[...]

Read more ...

Welcome to Finbee – our new member

[...]

Read more ...

The potential for financial instruments supporting migrant integration

[...]

Read more ...Resources

Discover a world of knowledge with our resources, carefully curated by the Microfinance Centre (MFC). Uncover valuable insights from research results, addressing capacity-building needs, and showcasing key trends in microfinance. Explore diverse topics through case studies, policy papers, and webinars, offering practical solutions and tools. Broaden your perspective with external publications. Your gateway to easy-to-understand microfinance insights is right here!