The European Union Code of Good Conduct for microcredit providers

The EU Commission invites you to endorse the European Union Code of Good Conduct for microcredit providers

Objectives of the Code

The European Union Code of Good Conduct for microcredit providers (the Code) presents good practice guidelines to enable the microfinance sector to face the challenge of accessing long-term finance. It details common standards around microfinance provider operations and reporting. The purpose of the Code is to neither introduce nor replace existing regulation of microcredit providers, but rather to promote best practice in order to maintain and raise the quality of services provided by the sector in member states.

The objectives of this Code resonate strongly with the MFC’s new strategy to promote transparency and fulfill minimum standards for client protection (enshrined in the 7 Client Protection Principles) across the sector. As such, the MFC welcomes the European Commission initiative and will encourage and support its European members to implement the Code.

How the Code was developed?

The Code was designed within the framework of JASMINE, a pilot project developed in the aftermath of a Communication “A European initiative for the development of microcredit in support of growth and employment” in member states adopted by the European Commission in November 2007.

Responding to the need to promote client-friendly good practice among MFIs, the Code was developed in close consultation with regional stakeholders and industry experts. Recognizing the disparate regulatory frameworks under which European microfinance providers operate, the Code unifies a set of expectations and common standards, for the benefit of providers as well as their funders, investors, clients, owners, regulators and partner organizations.

Who is Code for?

The Code is primarily designed to cover non-bank microfinance providers that provide loans of up to €25,000 to microentrepreneurs.

What does the Code include?

The Code is divided into 5 sections comprising 176 clauses. The number of clauses which institution has to comply with depends on its size, national regulatory framework and relevancy to the provider:

1. Customer and investor relations: addresses the obligations of microfinance providers towards customers and investors, and the rights of customers and investors

2. Governance: contains standards for both management and the board of microfinance providers

3. Common reporting standards: details which indicators microfinance providers must collect, report and disclose

4. Management information systems: outlines common standards for management information systems

5. Risk management: addresses common approaches and procedures for managing risk

The Code clauses are in line with 7 Client Protection principles which MFC has been promoting for several years and expects all its members to implement.

Download the Code in 15 EU languages here.

Code implementation and recognition

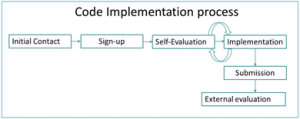

Microfinance providers interested in implementing the Code and being recognized for their work should undertake the following steps:

1. Sign up to the Code: Signing up to the Code involves making a formal commitment to apply its clauses to the work of interested organizations. Completed sign-up form should be sent to:

European Commission – DG Regional Policy

Unit B3 – Financial Instruments and relations with International Financial Institutions

Avenu

B-1160 Brussels

2. Complete a self-assessment questionnaire: at the outset of the process, interested providers should self-assess the degree to which they effectively implement the clauses of the Code.

3. Implement the Code: Based on the results of the self-assessment, the provider should plan and implement changes to comply with a number of clauses to reach the minimum global standard. A number of self-help tools and guidance are available to support providers in this process, which are included into the provider guidelines. Each participating organization will have 18 months to implement changes needed to ensure compliance with the Code (with extensions available where needed). Providers will be given support, advice and feedback concerning steps required to achieve Code compliance.

4. Verify your compliance: Apply to an external evaluator to verify Code compliance levels. Satisfactory compliance means that providers meet all of the priority clauses and 80% of the clauses that are applicable to the provider.

5. Award decision: At the close of the verification process, the evaluator will document findings and make a recommendation concerning the award. This report is submitted to the Steering Committee, which takes the final awarding decision. The evaluator will share the report with the provider before submitting it to the Committee. It is also sent to the provider together with the award decision letter.