Social Finance Vibe 2025: Registration Opens Soon

📅 Save the date: November 5-6, 2025

Our flagship virtual learning event, Social Finance Vibe 2025, returns with the theme “The Great Rebalancing“.

This two-day online event will bring together leading voices from microfinance, social economy, development finance and policy to explore how our sector can adapt and lead during times of uncertainty and geopolitical tension.

The agenda will spotlight:

- Carbon credit systems for microfinance clients

- Responsible AI and digital transformation in social finance

- Financing climate adaptation and resilience

- Fintech models tailored to microfinance

- Housing solutions for energy transition

- Youth-led approaches to social economy

- EU instruments and the future of the Social Economy Action Plan

Social Finance Vibe has been described by our partners as a benchmark in the online event space — and this year’s edition promises more critical insights, peer learning, and cross-sector collaboration.

🎥 Watch the 2024 session recordings

📅 Stay tuned — agenda and registration details will be available soon!

Join Our 27 August Info Meeting and Partner with Us in Autumn Campaigns: Borrow Wisely & Senior Entrepreneurship

The Microfinance Centre invites all microfinance institutions − especially MFC members − to take part in our upcoming autumn campaigns promoting responsible finance and inclusive entrepreneurship.

Borrow Wisely Campaign October 2025

Now in its 11th year, the Borrow Wisely Campaign continues to promote responsible borrowing practices among micro-entrepreneurs across Europe and Central Asia.

By participating, MFIs can highlight their commitment to customer protection and responsible lending, strengthening both their reputation and the broader microfinance sector.

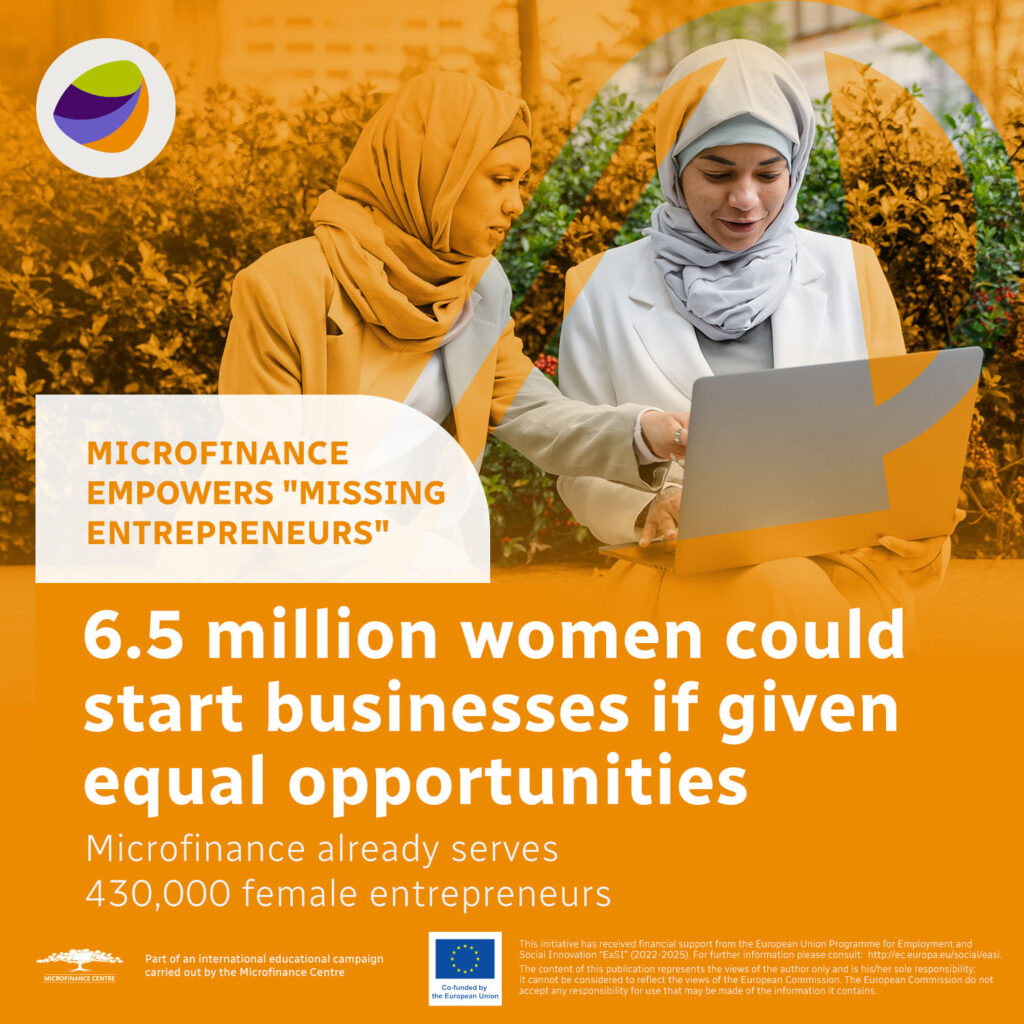

Senior Entrepreneurship & Self-Employment Campaign 2025

In response to demographic trends across the EU and OECD, and building on findings from the Missing Entrepreneurs report, MFC and its partners will launch a campaign highlighting the role of microfinance in supporting senior entrepreneurs (aged 50–64).

The online campaign will feature data insights and real-life success stories, showing how microfinance can empower older adults to remain economically active through self-employment and entrepreneurship.

Previous campaigns − Microfinance for Female Entrepreneurship and Microfinance for Youth Entrepreneurship − have demonstrated the strong visibility and impact this initiative can deliver.

To learn how your organization can get involved, join our information meeting on August 27th (Wednesday) at 11:00 AM (Warsaw time) on Zoom platform.

Microfinance for Senior Entrepreneurship and Self-Employment

27th MFC Annual Conference Through Highlight Video, Remarkable Images and Media Coverage

Thank you for being part of the 27th MFC Annual Conference!

Thank you for joining us in Tbilisi for the 27th MFC Annual Conference – Shifts, Shocks and Solutions: Microfinance in the Shadow of Geopolitics, held on 27–29 May 2025.

We’re really grateful you decided to spend these few days with us — sharing your ideas, experiences, and helping create an atmosphere that was open, engaging and full of energy.

Conferences are never just about the sessions — they’re about the people who make them special. This year, your participation helped create important conversations, connections and insights that made the event better for everyone. We hope you’re leaving with new relationships, useful takeaways, and a stronger sense of purpose.

27th MFC Annual Conference Highlights:

- Over 470 attendees from 40+ countries

- 20 sessions

- 50+ speakers, including two special guest speakers: Natia Turnava, Chair of the Board, National Bank of Georgi and Manas Chawla, Founder of London Politica

- A record number of 50+ sponsors, investors, and donors

- 1000+ meetings scheduled via the new MFC Mobile & Web Application

We Value Your Feedback

To help us continue improving, we’d greatly appreciate your input. Please take a few minutes to complete our post-event survey — your feedback is essential to shaping the future of MFC events.

We’ll be sharing presentations, recordings, and photos soon — keep an eye on your inbox and the MFC website.

Big thank you to all partners

We are grateful for the support of the conference sponsors and partners.

Honorary Patronage:

🌟 National Bank of Georgia

Silver Partners:

🌟 BlueOrchard Finance Ltd

🌟 responsAbility Investments AG

🌟 Bank CRYSTAL

Bronze Partners:

🌟Finance in Motion

🌟 European Fund for Southeast Europe (EFSE)

🌟 Kiya.ai

🌟 MFX Currency Risk Solutions Solutions

Cocktail Reception Partner:

🌟 კრედო ბანკი / Credo Bank

Networking Lunch Presenter:

🌟 Mastercard

Tech Partner:

🌟Fimple

Impact Management Partner:

🌟 Agents for Impact

Other Partners:

🌟 Georgian Microfinance Association

🌟 Frankfurt School of Finance & Management

🌟 Q-Lana Inc

🌟 Aspekt

🌟 Triple Jump

🌟 Global Gender-Smart Fund (GGSF)

🌟 MicroEurope

🌟 zypl.ai

Media Partner:

🌟 FinDev Gateway

To learn more about our sponsors, partners, and esteemed speakers, visit: https://2025.mfc.org.pl/partners/

Summary: Borrow Wisely and Microfinance for Youth Entrepreneurs Campaigns 2024

Discover the Key Social Finance Trends of 2024

We share the Key Trends in Microfinance and Social Finance Sector of 2024! Our concise yet comprehensive report covers:

- Public sector engagement

- ESG for social economy

- Innovation

- Technology and finance

We’ve meticulously tracked and analyzed the novelties, practices, and discussions from practitioners, national sectors, and at the EU level. Don’t miss out on the best practices and new solutions that are defining this year’s crucial content.

Let’s make 2025 more innovative, diverse, and greener!

2024: What a Year!

As 2025 is already underway, we take a moment to reflect on MFC’s incredible journey in 2024 and extend our heartfelt gratitude to our partners and friends for empowering communities across Europe and Central Asia through sustainable finance.

We wish you resilience and success in the face of challenges this year. Together, let’s make 2025 more innovative, diverse, and greener!

Here are some standout highlights from MFC’s 2024:

- 26th MFC Annual Conference in Krakow: Hosted 127 microfinance and social enterprise finance institutions, 12 microfinance national associations, 28 investors, 13 consultancies, 9 policymakers and regulators, and 5 IT and digital service providers from Europe and Central Asia.

- Social Finance Vibe Virtual Conference: Attracted 422 participants from over 70 countries during an impactful 2-day event.

- CEE Social Economy Forum in Vienna: For the first time, this forum gathered policymakers, ESF+ managing authorities, national promotional banks, microfinance and social finance providers, impact investors, and experts from the EC, EIB Group, and Council of Europe Development Bank. MFC proudly co-organized and played a pivotal role in this landmark event.

- SIFTA Success: A very productive year with 40 events organized under the Social Inclusive Finance Technical Assistance (SIFTA) program, including 20 webinars and workshops, 20 tailored services, and 970 participants.

- Transform Together Fund (TTF) Project: Partnered with Cerise+SPTF we granted 8 social finance organizations to support innovative projects in digital and green areas.

- Advocacy Milestones: Strong representation at key events, including the European Federation of Ethical and Alternative Banks and Financiers’ Annual Conference in Ireland, and significant meetings with representatives of the European Commission (DG EMPL, DG NEAR, and DG ECFIN). These efforts, alongside partners like the European Microfinance Network and Social Economy Europe, furthered our mission for a fairer and more sustainable economic future.

- The Way to Business Program: Successfully completed, enabling female refugees from Ukraine to start businesses or restart their careers in Poland.

- Borrow Wisely and Microfinance for Youth Entrepreneurship Campaigns: Partnered with 19 microfinance organizations across 7 European markets, reaching over 1.5 million people through online and offline channels.

- Representation at Partner Conferences: MFC played a strong role at the MicroBalkans and Azerbaijan Microfinance Association events.

- European Microfinance Day Campaign: Culminated in Brussels with MFC’s representation by council members Martina Grigorova (SIS Credit, Bulgaria) and Elma Zukic (AMFI, Bosnia and Herzegovina), alongside Network and Partnership Manager, Pavol Kapsdorfer.

- European Microfinance Week: Delivered impactful sessions on financial inclusion for refugees, showcasing MFC’s expertise and network.

- Key Publications and Surveys: Released groundbreaking reports, including Microfinance in Europe: Survey Report (2023 Edition), Social Finance Trends 2024, Microfinance in the Caucasus and Central Asia: 2024 Edition, and Green Paper: Supporting Micro and Small Entrepreneurs for a Fair Green Transition.

- Green Leadership: MFC’s CEO, Katarzyna Pawlak, joined the Barcelona Action Circle on Post-growth Finance as an expert in sustainable finance and microfinance.

- Team Retreat: A reset and brainstorming session for the MFC team in Kowalewice.

2025: Let’s take small steps toward meaningful change, together!

#Microfinance #SocialEconomy #InclusiveFinance #SustainableDevelopment #MFC2024Highlights #BestMFCMoments #SIFTA

Happy Holiday Season

Wishing you light, love, and moments of relaxation during this holiday season. May the New Year bring a more inclusive, greener, and fairer world for all.

We look forward to achieving even greater milestones together in the coming year.

Happy Holidays and an Innovative New Year from all of us at the Microfinance Centre!

Thank you for Social Finance Vibe 2024

We’ve wrapped up an incredible 2 days of Social Finance Vibe filled with insights, inspiration and collaboration. From speakers and sponsors to attendees, we extend our gratitude for your invaluable support and active participation.

Social Finance Vibe 2024 Highlights:

- Over 400 attendees from 70+ countries

- 26 sessions and over 60 expert speakers

- Two organizations honored in the Green Recognition Ceremony: Faer (Romania), Credal (Belgium)

- Inspiring talks by keynote speakers: Andriana Sukova (Deputy Director General of DG Employment at the European Commission), Timothy Ogden (Managing Director at the Financial Access Initiative at New York University’s Wagner School of Public Service)and Archil Bakuradze (Chairman of JSC MFO Crystal and MFC Council Chairman).

- Focus on 3 key themes: social economy, client diversity and exploration of megatrends

Recordings of all sessions will be available on our website soon.

Thank you for helping make Social Finance Vibe 2024 special. We’re grateful for the opportunity to learn, connect and strengthen the visibility of the social economy and microfinance sectors with you.

We look forward to seeing you at future events.

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the granting authority can be held responsible for them.

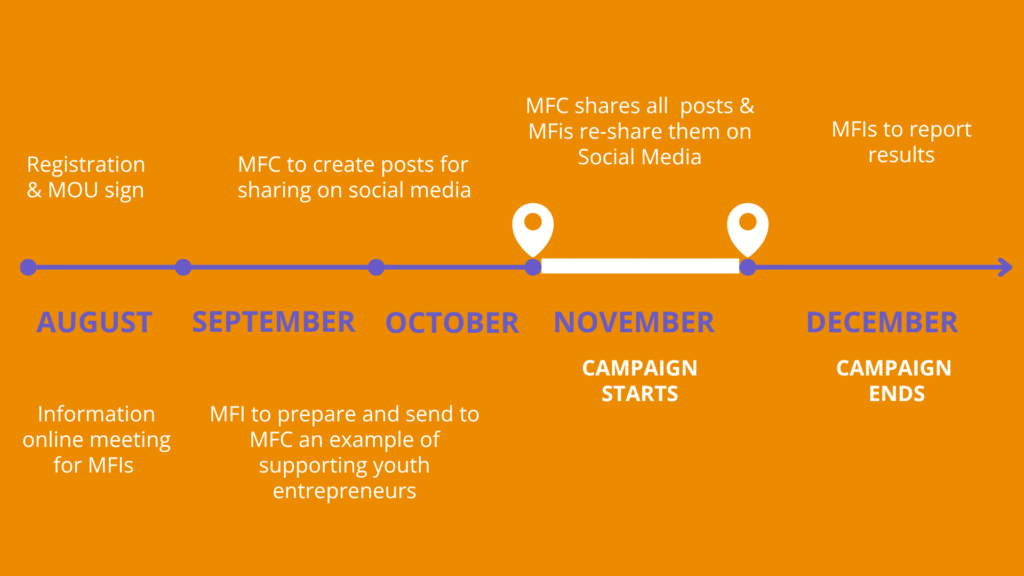

Microfinance for Youth Entrepreneurship Campaign 2024

The Microfinance Centre (MFC) is committed to ensuring equal opportunities for young people to start their own businesses and is launching the Microfinance for Youth Entrepreneurship Campaign 2024. Together with its partners, MFC aims to spotlight the essential role of the microfinance sector in empowering young entrepreneurs. This campaign will share key insights from the recent publication Missing Entrepreneurs 2023 and highlight success stories from various microfinance institutions across Europe.

Through this initiative, MFC will expand its reach to engage microfinance stakeholders and underscore the sector’s critical role in supporting youth entrepreneurship. According to Missing Entrepreneurs 2023, around 40% of young people in the EU, aged 15 to 30, aspire to be self-employed. However, barriers such as limited entrepreneurial skills, constrained networking opportunities, and restricted access to finance continue to hinder young people’s ability to start businesses or become self-employed, despite increased support.

Ewa Bankowska, MFC Deputy Director, stated: The Microfinance Centre and its partners have supported the ‘missing entrepreneurs’ for over 2 years. By sharing success stories and building awareness, we advocate for microfinance as a vital bridge for young entrepreneurs facing financial barriers. Last year’s campaign highlighted the role of microfinance in supporting female entrepreneurship and this year, we’re focusing on youth. Notably, 89% of European MFIs already finance young entrepreneurs’ ventures. Our mission is to boost young entrepreneurship internationally through microfinancing.

The Missing Entrepreneurs 2023 is the seventh edition in a series of biennial reports examining how government policies can release untapped entrepreneurial potential from under-represented parts of the population of impactful entrepreneurs, including women, youth, seniors, the unemployed, immigrants and people with disabilities.

Participating organizations include:

- 3Bank

- Prima Finantare

- Microinvest

- Vitas30

- Partner

- Fondi Besa

- Microsmart

- Mi-Bospo

- AMFI

- FedInvest

- EKI

- NOA

- BCR Social Finance IFN

- Moznosti

- Agro and Social Fund

- AMA

- Kredo

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the granting authority can be held responsible for them.

The Missing Entrepreneurs 2023 is the seventh edition in a series of biennial reports examining how government policies can release untapped entrepreneurial potential from under-represented parts of the population of impactful entrepreneurs, including women, youth, seniors, the unemployed, immigrants and people with disabilities. It offers comparative data on the entrepreneurship activities and the barriers faced by each group across OECD and European Union countries. It takes a deep dive into the effectiveness of youth entrepreneurship schemes and the design of welfare bridge schemes for business creation by job seekers. It also contains country profiles for each of the 27 EU Member States showing the major recent trends in diversity in entrepreneurship and the current state and evolution of policy for each country.

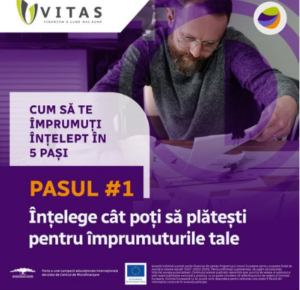

Borrow Wisely Campaign 2024

How much is safe to borrow? What will I really pay for a loan? Can I spot legal pitfalls? How do I avoid losing money? These are the essential questions at the heart of the Borrow Wisely campaign. This year marks the 10th edition of this international financial education initiative, led by the Microfinance Center (MFC) in partnership with 14 organizations across Europe. The campaign aims to help clients borrow money safely, avoid over-indebtedness, and build a trustworthy reputation for the microfinance sector.

What is the “Borrow Wisely” Campaign?

The “Borrow Wisely” campaign promotes global client protection standards. Led annually by the Microfinance Center and its partners − responsible lenders committed to building a trustworthy microfinance sector − the campaign seeks to educate clients on borrowing wisely and avoiding the pitfalls of excessive debt.

Empowering Borrowers to Make Informed Choices

The campaign’s goal is to help clients understand that the power to borrow wisely is in their hands. By asking the right questions, borrowers can avoid the risks of over-indebtedness and make well-informed decisions about how much they can safely borrow.

Why Microfinance Institutions Join Forces

For over 30 years, microfinance institutions have been committed to protecting their clients by promoting responsible borrowing practices. This campaign reinforces the importance of client protection, helping to prevent over-indebtedness and empowering clients to make informed financial decisions. By working together, microfinance institutions ensure they continue to serve their clients effectively while upholding international standards for responsible lending.

What We Do

The campaign reaches out to clients and potential clients of microfinance institutions through posters, leaflets, brochures and social media communicating the importance of borrowing wisely. A simple “pre-loan” checklist of questions helps ensure that clients borrow within safe and responsible limits.

Ewa Bankowska, MFC Deputy Director, said: Microfinance acknowledges its partners for their dedication to promoting the Borrow Wisely Campaign and achieving significant results over the years. Last year alone, we reached an audience of approximately 2,423,487 individuals through a blend of online and traditional communication methods. At the Microfinance Center, collaboration is key, and together with our 14 partners, we are making a more substantial impact in promoting responsible borrowing practices.

Campaign Partners 2024:

- Prima Finantare, Moldova

- Microinvest. Moldova

- Vitas, Romania

- Partner, Bosnia and Herzegovina

- Fondi Besa, Albania

- Mi-Bospo, Bosnia and Herzegovina

- AMFI, Bosnia and Herzegovina

- FED Invest, Albania

- EKI, Bosnia and Herzegovina

- IUTE, Albania

- NOA, Albania

- Microsmart, Greece

- Horizonti, Macedonia

- Moznosti, Macedonia

- Agro & Social Fund, Albania

- The Albanian Microfinance Association, Albania

- Kredo, Albania

Celebrating the Resounding Success of the 26th MFC Annual Conference Through Remarkable Images

The Microfinance Centre (MFC) is proud to announce the resounding success of the 26th MFC Annual Conference Embracing Diversity for Inclusive Finance. Held on May 14-15, 2024, in Cracow, Poland, the event gathered approximately 400+ participants from 39 countries, creating a dynamic atmosphere for insightful dialogue and networking.

The conference attracted the microfinance providers from 127 microfinance and social enterprise finance providers, 12 microfinance national associations, 28 investors, 13 consultancies, 9 policymakers and regulators, and 5 IT & digital services providers.

Attendees highlighted key aspects of the event: 64% valued meeting potential business partners, 61% found the sessions highly informative, and 71% appreciated the relevance of the sessions to their work and the professionalism of the speakers. Furthermore, 89% of participants felt they had ample time to engage with other participants, leading to numerous significant connections and discussions (*).

The conference featured a diverse array of sessions addressing pressing issues in microfinance. Participants engaged in thought-provoking conversations led by industry experts and thought leaders, exploring topics such as pathways to inclusive finance, innovative approaches to climate change, leveraging technology for greater financial inclusion, ESG reporting as a catalyst for microfinance transformation and the intersection of finance and social impact. Sessions underscored microfinance’s role in empowering vulnerable entrepreneurs, navigating trends in inclusive finance, and harnessing artificial intelligence for diverse and inclusive microfinance.

The Microfinance Center had privilege of hosting distinguished speakers and moderators, including Cristina Dumitrescu from European Investment Fund (Luxembourg), Surjit Chana from Beneficial State Bank (United States), Florian Ott from Erste Group Bank AG (Germany), Elvina Garayeva from Incofin Investment Management (Belgium), Brigitte Fellahi-Brognaux from European Commission, DG EMPL (Belgium), and many more esteemed experts (the full list of speakers is on: www.2024mfc.org). Their insightful presentations and expertise greatly enriched the conference.

During the conference, MFC hosted a landmark roundtable with representatives from the National Banks of Armenia, Georgia, Kyrgyzstan, Tajikistan, and Uzbekistan, alongside delegates from the Asian Development Bank (ADB) and International Finance Corporation (IFC). Participants deliberated on strategies to promote sustainable growth in the microfinance industry, with a focus on financial stability and consumer protection. Regulators discussed addressing challenges within their respective countries, while ADB and IFC representatives shared their extensive experiences, offering valuable advice on regulatory frameworks.

The roundtable concluded with a commitment to ongoing knowledge sharing and policy discussions aimed at fostering a supportive regulatory environment. A subsequent networking lunch furthered opportunities for dialogue and collaboration, including additional representatives from Bosnia and Herzegovina, Kosovo, and national microfinance associations.

The MFC Annual Conference provides a unique opportunity to establish new partnerships between funders and social finance providers. Each year, we are happy to welcome new stakeholders joining the MFC family – remarked Archil Bakuradze, MFC Council Chairman and Chair of the Supervisory Board at JSC MFO Crystal, Georgia.

Ewa Bańkowska, MFC Deputy Director emphasized: The microfinance sector continues to diversify by welcoming new types of financial providers, funders, but most importantly by expanding the outreach to vulnerable groups such as migrants or social enterprises. The diverse and dynamic interactions during the conference underscored the importance of embracing diversity to achieve financial inclusivity.

The conference was generously supported by sponsors: European Investment Fund (EIF), responsAbility Investments AG, Bank Gospodarstwa Krajowego, BlueOrchard, Frankfurt School of Finance & Management, Finance in Motion, The European Fund for Southeast Europe (EFSE) and partners: Agents for Impact GmbH, Accion, Aspekt, Incofin, Triple Jump, Polish Bank Association, CGAP’s FinDev Gateway.

See more remarkable images from the Annual Conference

About Microfinance Centre (MFC):

The MFC is a social finance network that champions fairness, inclusion, equality, and responsible service. It unites over 130 organizations across 36 countries in Europe and Central Asia, collectively delivering responsible microfinance services to nearly 2,000,000 low-income clients. Together with our members – microfinance, financial cooperative systems, social finance banks, social investors, academic institutions, national and international support organizations and networks – we seek to make financial services work effectively for people, communities and the planet by embracing sustainability good practices and standards, sharing knowledge, advocacy and networking in the region of Europe and Central Asia.

END

Contact Information:

Joanna Sosnowska-Orynska, Communications Coordinator at MFC

Email: joanna.sosnowska@mfc.org.pl

(*) According to evaluation survey results

Watch SIFTA Webinar: AI powered solutions for SEFPs – Responsible AI, Machine Learning and Practical Use Cases for Microfinance and Social Finance Institutions

Our Experts

Andre Kravchenko – Senior Vice President of Business Development at HES FinTech

Andre Kravchenko is the Senior Vice President of Business Development at HES FinTech. In this role, Andre is responsible for the development of strategic partnerships in the financial services ecosystem, working with legacy and fintech lending institutions on driving digital transformation, innovation and financial inclusion, powered by AI and Machine Learning. Andre is also the Head of Fintech Capital Solutions Advisory at HES FinTech, bringing over a decade worth of debt and equity capital markets experience and extensive transactional track record in the impact investment space.

Gift Mahubo – Senior Director, Operations and Technology, Accion Advisory

Gift Mahubo manages the delivery of data-centered and tech-enabled services to our global partners. Gift joined Accion in 2011 and brings more than 20 years of experience working in the areas of technology, digital strategy, process automation and digital product implementation. Prior to joining the organization, he served as Chief Information Officer for Accion partner Accion Microfinance Bank. Gift holds an MBA from National University of Science and Technology, Zimbabwe and a degree in electronic engineering, and is certified in IT governance, information security, auditing, compliance and project management.

Mark Rudak – Machine Learning Product Owner, GiniMachine

Mark Rudak holds the position of Machine Learning Product Owner at HES Fintech, where he plays a key role in the planning and development of a cutting-edge machine learning-based platform – GiniMachine, a no-code AI solution for Data Driven Decisioning.

With a deep understanding of the industry landscape, Mark is a driving force behind the transition towards responsible deployment of AI and strategic utilization of alternative data sources.

Our partners

Watch SIFTA Webinar: How to analyze social enterprises – Demystifying Financing Social Enterprise: Analysis, Risks & Rewards

Our Experts

Teresa Zagrodzka – senior expert in the field of financing social enterprises as well as being a professional advisor and trainer for the NGOs sector.

She headed the Social Economy department in TISE – Polish microfinance institution which implemented pilot program: preferential loans for social enterprises in Poland, then continued with the developed financial instruments for these entities also in other countries: Slovakia, Slovenia, Croatia, Hungary. As an expert, trainer and adviser she participated in the project creating the social enterprises’ support ecosystem in North Macedonia in terms of reinforcement already existing entities, encouraging potential partners to finance them (including loans, donations, contracts).

In the role of MB member or financial director she was and still is in charge of finance management in few organizations that run economic activity.

She wrote many articles and publications on finance management, basic accountancy for non-accountants, dedicated to NGO managers. She is also co-author of manual on an innovative social impact bonds concept, report on financial sources for innovative projects in Poland or several reports on the Macedonian social entrepreneurship needs, condition and development directions.

Beata Biela – Advocacy Manager.

Beata has professional experience both in social economy sector and in business entities. She worked in TISE within social economy division both in grating loans to social economy entities and in Social Venture Capital. Before that she worked in Caritas Somalia in Africa, at Finance Commission of Caritas Internationalis in Rome, PAH. In the past, she worked in business entities like PKN Orlen (capital investments), PKP (capital group controlling), Pfeifer&Langen – previously BSO Polska (controlling and business development), Ernst&Young (due diligence, corporate finance, audit). She graduated from Warsaw School of Economics in the line of Finance and Banking as well as Management and Marketing. She also completed postgraduate studies of Geopolitics and Geostrategy, Global Development, MBA. She is a CFA charterholder.

Our partners

Watch SIFTA Webinar: How to give employees constructive feedback

Our Experts

Bożena Olszewska, Servant Leadership trainer, coach and emphatic communication trainer

Bożena for over 15 years has been practicing the use of modern forms of education such as coaching, career counselling, Career Compass and behavioral style profiling.

She supports people and organizations in following and discovering direction and empowering strategies that flow from their values and needs.

Throughout her career, she has been in charge of distribution, developing contractor networks and sourcing new markets in Europe, Asia and the USA. At the same time, she led groups and teams in non profit organizations. She also supports artistic communities, aimed at the personal development of artists.

Our partners

FEBEA and MFC Join Forces to Strengthen Microfinance and Ethical Finance in Europe

Setting up financial instruments supporting migrant integration.

Watch Webinar: MFC and Tech to the Rescue

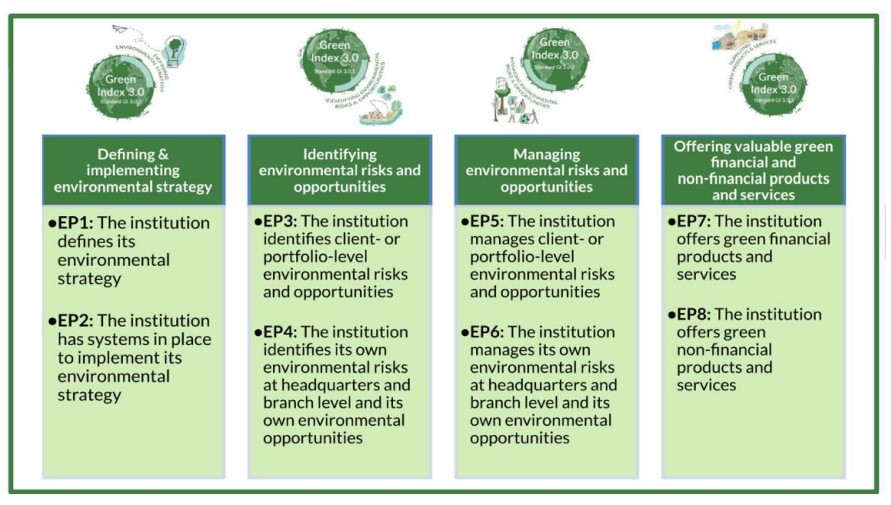

Green Index 3.0: case studies for each Essential Practice

Unlocking Private Capital for Social Good in Central & Eastern Europe

Microfinance Sector Contribution to the European Pillar of Social Rights Action Plan

The Microfinance Centre (MFC) and European Microfinance Network (EMN) have submitted a joint recommendation to the European Commission’s consultation on the new Action Plan for the implementation of the European Pillar of Social Rights (EPSR).

Microfinance institutions (MFIs) across Europe and Central Asia serve nearly 2 million low-income clients, offering financial and non-financial services that support employment, entrepreneurship, and social inclusion. The sector plays a key role in reaching underserved groups, including women, youth, migrants, ethnic minorities, and rural populations.

The joint contribution highlights the sector’s impact and outlines recommendations to strengthen its role in delivering EPSR objectives:

- Align EPSR with other EU initiatives to improve policy coherence and recognize microfinance as a delivery tool.

- Ensure access to appropriate EU-level financial instruments to support inclusive finance.

- Encourage Member States to integrate microfinance into national and regional strategies and promote collaboration between public and private stakeholders.

- Improve impact measurement frameworks to better track outcomes and inform policy.

These recommendations aim to support the EU’s 2030 social targets, including increased employment, lifelong learning, and reduced poverty and social exclusion.

For more information on the Action Plan and consultation process, visit the European Commission’s initiative page.

European Commission opens consultations on Housing, Social Rights and Poverty

The European Commission has launched a series of public consultations to gather input for future EU policies concerning social housing, the European Pillar of Social Rights (EPSR) Action Plan, and an EU Anti-Poverty Strategy. These initiatives aim to address pressing social challenges across the Union, from housing affordability to poverty reduction:

- EPSR Action Plan: This initiative seeks to provide new impetus for a fairer and more inclusive Social Europe, updating the EU’s social blueprint. It aims to address persistent gaps in achieving the 2030 EU headline targets for employment, skills, and poverty reduction, particularly noting that while employment is close to its target, significant efforts are still needed for skills and poverty reduction. The plan will adapt to the rapidly evolving socio-economic and geopolitical context. The consultation deadline is 10 September 2025.

- European Affordable Housing Plan: As the first-ever such plan, it seeks to provide EU solutions to the urgent housing crisis impacting millions of families and young people across the EU. Housing affordability has deteriorated, leading to critical shortages and increased costs that burden vulnerable populations and affect EU competitiveness. The plan aims to mobilize investment in housing supply, ease access to affordable housing, and remove obstacles to supply. The consultation deadline is 17 October 2025.

- EU Anti-Poverty Strategy: This first-ever EU Anti-Poverty Strategy aims to create a framework for concerted action to address the systemic drivers and root causes of poverty. With, on average, over 20% of the EU population, and up to 25% of children, at risk of poverty or social exclusion, substantial efforts are still required to meet the 2030 target of reducing the people at risk of poverty or social exclusion by 15 million as compared to 2019. The strategy will aim to break the intergenerational transmission of poverty and mainstream poverty considerations across other policy areas. The consultation deadline is 24 October 2025.

The Microfinance Centre (MFC), in collaboration with the European Microfinance Network (EMN), is actively preparing to submit joint feedbacks to these consultations, advocating for the vital role of microfinance in each of the above-mentioned field.

***

@Photo by Guillaume Périgois on Unsplash

Catch Up on What Matters: SIFTA Webinars Now Online

Missed a SIFTA webinar? You can now watch all past sessions online.

Topics include AI-powered services, digital and green skills, financial planning and modeling, product development, internal audit and managing multi-generational teams.

The SIFTA webinar series explores the themes shaping inclusive finance today.

Let’s run Borrow Wisely Campaign 2025 together

Upcoming Local Activities Under the SIFTA Programme

This autumn, the Microfinance Centre will continue leading the Social Inclusive Finance Technical Assistance (SIFTA) Programme, coordinating a new round of local webinars and workshops in national languages across the EU.

Planned activities include collaboration with MFC members on the following themes:

- Croatia (HUKU): Credit unions will explore updates to anti-money laundering (AML) regulations.

- Italy (RITMI): MFIs will focus on social media marketing.

- Greece (Microsmart): Discussions will highlight the role of microfinance and inclusive finance in national economic development.

- Bulgaria (SIS Credit): Partners will work to strengthen collaboration for greater social impact.

If your organisation is based in the EU27 and interested in hosting local SIFTA capacity-building activities, please contact Joanna Żukowska, Project Coordinator: joanna@mfc.org.pl

👉 See what we achieved together in H1: https://mfc.org.pl/sifta-mid-year-highlights-a-strong-start-to-2025/

Microcredit and Local Development in Southern Italy: Highlights from the Tricase Workshop

On July 28th, the town of Tricase hosted a full-day workshop dedicated to the role of microfinance in advancing local development and youth entrepreneurship in Southern Italy’s inner areas.

Organized by MFC and Rete Italiana di Microfinanza – RITMI under the SIFTA Program, the event brought together Italian MFIs, SEFPs, civil society, public institutions, and academics for strategic dialogue on how microcredit and civil economy approaches can revitalize marginal territories.

The agenda featured leading voices from regional development and finance, with impactful discussions on youth enterprise, policy innovation, and the importance of place-based financial tools. Speakers included representatives from Tor Vergata University, Banca Popolare Pugliese, PerMicro, ARPAL Puglia, and local development agencies.

The workshop offered a platform for connection and exchange, reinforcing the role of microfinance in building inclusive, sustainable local economies.