Thank you for being part of the 27th MFC Annual Conference!

Thank you for joining us in Tbilisi for the 27th MFC Annual Conference – Shifts, Shocks and Solutions: Microfinance in the Shadow of Geopolitics, held on 27–29 May 2025.

We’re really grateful you decided to spend these few days with us — sharing your ideas, experiences, and helping create an atmosphere that was open, engaging and full of energy.

Conferences are never just about the sessions — they’re about the people who make them special. This year, your participation helped create important conversations, connections and insights that made the event better for everyone. We hope you’re leaving with new relationships, useful takeaways, and a stronger sense of purpose.

27th MFC Annual Conference Highlights:

- Over 470 attendees from 40+ countries

- 20 sessions

- 50+ speakers, including two special guest speakers: Natia Turnava, Chair of the Board, National Bank of Georgi and Manas Chawla, Founder of London Politica

- A record number of 50+ sponsors, investors, and donors

- 1000+ meetings scheduled via the new MFC Mobile & Web Application

We Value Your Feedback

To help us continue improving, we’d greatly appreciate your input. Please take a few minutes to complete our post-event survey — your feedback is essential to shaping the future of MFC events.

We’ll be sharing presentations, recordings, and photos soon — keep an eye on your inbox and the MFC website.

Big thank you to all partners

We are grateful for the support of the conference sponsors and partners.

Honorary Patronage:

🌟 National Bank of Georgia

Silver Partners:

🌟 BlueOrchard Finance Ltd

🌟 responsAbility Investments AG

🌟 Bank CRYSTAL

Bronze Partners:

🌟Finance in Motion

🌟 European Fund for Southeast Europe (EFSE)

🌟 Kiya.ai

🌟 MFX Currency Risk Solutions Solutions

Cocktail Reception Partner:

🌟 კრედო ბანკი / Credo Bank

Networking Lunch Presenter:

🌟 Mastercard

Tech Partner:

🌟Fimple

Impact Management Partner:

🌟 Agents for Impact

Other Partners:

🌟 Georgian Microfinance Association

🌟 Frankfurt School of Finance & Management

🌟 Q-Lana Inc

🌟 Aspekt

🌟 Triple Jump

🌟 Global Gender-Smart Fund (GGSF)

🌟 MicroEurope

🌟 zypl.ai

Media Partner:

🌟 FinDev Gateway

To learn more about our sponsors, partners, and esteemed speakers, visit: https://2025.mfc.org.pl/partners/

Summary: Borrow Wisely and Microfinance for Youth Entrepreneurs Campaigns 2024

Discover the Key Social Finance Trends of 2024

We share the Key Trends in Microfinance and Social Finance Sector of 2024! Our concise yet comprehensive report covers:

- Public sector engagement

- ESG for social economy

- Innovation

- Technology and finance

We’ve meticulously tracked and analyzed the novelties, practices, and discussions from practitioners, national sectors, and at the EU level. Don’t miss out on the best practices and new solutions that are defining this year’s crucial content.

Let’s make 2025 more innovative, diverse, and greener!

2024: What a Year!

As 2025 is already underway, we take a moment to reflect on MFC’s incredible journey in 2024 and extend our heartfelt gratitude to our partners and friends for empowering communities across Europe and Central Asia through sustainable finance.

We wish you resilience and success in the face of challenges this year. Together, let’s make 2025 more innovative, diverse, and greener!

Here are some standout highlights from MFC’s 2024:

- 26th MFC Annual Conference in Krakow: Hosted 127 microfinance and social enterprise finance institutions, 12 microfinance national associations, 28 investors, 13 consultancies, 9 policymakers and regulators, and 5 IT and digital service providers from Europe and Central Asia.

- Social Finance Vibe Virtual Conference: Attracted 422 participants from over 70 countries during an impactful 2-day event.

- CEE Social Economy Forum in Vienna: For the first time, this forum gathered policymakers, ESF+ managing authorities, national promotional banks, microfinance and social finance providers, impact investors, and experts from the EC, EIB Group, and Council of Europe Development Bank. MFC proudly co-organized and played a pivotal role in this landmark event.

- SIFTA Success: A very productive year with 40 events organized under the Social Inclusive Finance Technical Assistance (SIFTA) program, including 20 webinars and workshops, 20 tailored services, and 970 participants.

- Transform Together Fund (TTF) Project: Partnered with Cerise+SPTF we granted 8 social finance organizations to support innovative projects in digital and green areas.

- Advocacy Milestones: Strong representation at key events, including the European Federation of Ethical and Alternative Banks and Financiers’ Annual Conference in Ireland, and significant meetings with representatives of the European Commission (DG EMPL, DG NEAR, and DG ECFIN). These efforts, alongside partners like the European Microfinance Network and Social Economy Europe, furthered our mission for a fairer and more sustainable economic future.

- The Way to Business Program: Successfully completed, enabling female refugees from Ukraine to start businesses or restart their careers in Poland.

- Borrow Wisely and Microfinance for Youth Entrepreneurship Campaigns: Partnered with 19 microfinance organizations across 7 European markets, reaching over 1.5 million people through online and offline channels.

- Representation at Partner Conferences: MFC played a strong role at the MicroBalkans and Azerbaijan Microfinance Association events.

- European Microfinance Day Campaign: Culminated in Brussels with MFC’s representation by council members Martina Grigorova (SIS Credit, Bulgaria) and Elma Zukic (AMFI, Bosnia and Herzegovina), alongside Network and Partnership Manager, Pavol Kapsdorfer.

- European Microfinance Week: Delivered impactful sessions on financial inclusion for refugees, showcasing MFC’s expertise and network.

- Key Publications and Surveys: Released groundbreaking reports, including Microfinance in Europe: Survey Report (2023 Edition), Social Finance Trends 2024, Microfinance in the Caucasus and Central Asia: 2024 Edition, and Green Paper: Supporting Micro and Small Entrepreneurs for a Fair Green Transition.

- Green Leadership: MFC’s CEO, Katarzyna Pawlak, joined the Barcelona Action Circle on Post-growth Finance as an expert in sustainable finance and microfinance.

- Team Retreat: A reset and brainstorming session for the MFC team in Kowalewice.

2025: Let’s take small steps toward meaningful change, together!

#Microfinance #SocialEconomy #InclusiveFinance #SustainableDevelopment #MFC2024Highlights #BestMFCMoments #SIFTA

Happy Holiday Season

Wishing you light, love, and moments of relaxation during this holiday season. May the New Year bring a more inclusive, greener, and fairer world for all.

We look forward to achieving even greater milestones together in the coming year.

Happy Holidays and an Innovative New Year from all of us at the Microfinance Centre!

Thank you for Social Finance Vibe 2024

We’ve wrapped up an incredible 2 days of Social Finance Vibe filled with insights, inspiration and collaboration. From speakers and sponsors to attendees, we extend our gratitude for your invaluable support and active participation.

Social Finance Vibe 2024 Highlights:

- Over 400 attendees from 70+ countries

- 26 sessions and over 60 expert speakers

- Two organizations honored in the Green Recognition Ceremony: Faer (Romania), Credal (Belgium)

- Inspiring talks by keynote speakers: Andriana Sukova (Deputy Director General of DG Employment at the European Commission), Timothy Ogden (Managing Director at the Financial Access Initiative at New York University’s Wagner School of Public Service)and Archil Bakuradze (Chairman of JSC MFO Crystal and MFC Council Chairman).

- Focus on 3 key themes: social economy, client diversity and exploration of megatrends

Recordings of all sessions will be available on our website soon.

Thank you for helping make Social Finance Vibe 2024 special. We’re grateful for the opportunity to learn, connect and strengthen the visibility of the social economy and microfinance sectors with you.

We look forward to seeing you at future events.

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the granting authority can be held responsible for them.

Microfinance for Youth Entrepreneurship Campaign 2024

The Microfinance Centre (MFC) is committed to ensuring equal opportunities for young people to start their own businesses and is launching the Microfinance for Youth Entrepreneurship Campaign 2024. Together with its partners, MFC aims to spotlight the essential role of the microfinance sector in empowering young entrepreneurs. This campaign will share key insights from the recent publication Missing Entrepreneurs 2023 and highlight success stories from various microfinance institutions across Europe.

Through this initiative, MFC will expand its reach to engage microfinance stakeholders and underscore the sector’s critical role in supporting youth entrepreneurship. According to Missing Entrepreneurs 2023, around 40% of young people in the EU, aged 15 to 30, aspire to be self-employed. However, barriers such as limited entrepreneurial skills, constrained networking opportunities, and restricted access to finance continue to hinder young people’s ability to start businesses or become self-employed, despite increased support.

Ewa Bankowska, MFC Deputy Director, stated: The Microfinance Centre and its partners have supported the ‘missing entrepreneurs’ for over 2 years. By sharing success stories and building awareness, we advocate for microfinance as a vital bridge for young entrepreneurs facing financial barriers. Last year’s campaign highlighted the role of microfinance in supporting female entrepreneurship and this year, we’re focusing on youth. Notably, 89% of European MFIs already finance young entrepreneurs’ ventures. Our mission is to boost young entrepreneurship internationally through microfinancing.

The Missing Entrepreneurs 2023 is the seventh edition in a series of biennial reports examining how government policies can release untapped entrepreneurial potential from under-represented parts of the population of impactful entrepreneurs, including women, youth, seniors, the unemployed, immigrants and people with disabilities.

Participating organizations include:

- 3Bank

- Prima Finantare

- Microinvest

- Vitas30

- Partner

- Fondi Besa

- Microsmart

- Mi-Bospo

- AMFI

- FedInvest

- EKI

- NOA

- BCR Social Finance IFN

- Moznosti

- Agro and Social Fund

- AMA

- Kredo

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the granting authority can be held responsible for them.

The Missing Entrepreneurs 2023 is the seventh edition in a series of biennial reports examining how government policies can release untapped entrepreneurial potential from under-represented parts of the population of impactful entrepreneurs, including women, youth, seniors, the unemployed, immigrants and people with disabilities. It offers comparative data on the entrepreneurship activities and the barriers faced by each group across OECD and European Union countries. It takes a deep dive into the effectiveness of youth entrepreneurship schemes and the design of welfare bridge schemes for business creation by job seekers. It also contains country profiles for each of the 27 EU Member States showing the major recent trends in diversity in entrepreneurship and the current state and evolution of policy for each country.

Borrow Wisely Campaign 2024

How much is safe to borrow? What will I really pay for a loan? Can I spot legal pitfalls? How do I avoid losing money? These are the essential questions at the heart of the Borrow Wisely campaign. This year marks the 10th edition of this international financial education initiative, led by the Microfinance Center (MFC) in partnership with 14 organizations across Europe. The campaign aims to help clients borrow money safely, avoid over-indebtedness, and build a trustworthy reputation for the microfinance sector.

What is the “Borrow Wisely” Campaign?

The “Borrow Wisely” campaign promotes global client protection standards. Led annually by the Microfinance Center and its partners − responsible lenders committed to building a trustworthy microfinance sector − the campaign seeks to educate clients on borrowing wisely and avoiding the pitfalls of excessive debt.

Empowering Borrowers to Make Informed Choices

The campaign’s goal is to help clients understand that the power to borrow wisely is in their hands. By asking the right questions, borrowers can avoid the risks of over-indebtedness and make well-informed decisions about how much they can safely borrow.

Why Microfinance Institutions Join Forces

For over 30 years, microfinance institutions have been committed to protecting their clients by promoting responsible borrowing practices. This campaign reinforces the importance of client protection, helping to prevent over-indebtedness and empowering clients to make informed financial decisions. By working together, microfinance institutions ensure they continue to serve their clients effectively while upholding international standards for responsible lending.

What We Do

The campaign reaches out to clients and potential clients of microfinance institutions through posters, leaflets, brochures and social media communicating the importance of borrowing wisely. A simple “pre-loan” checklist of questions helps ensure that clients borrow within safe and responsible limits.

Ewa Bankowska, MFC Deputy Director, said: Microfinance acknowledges its partners for their dedication to promoting the Borrow Wisely Campaign and achieving significant results over the years. Last year alone, we reached an audience of approximately 2,423,487 individuals through a blend of online and traditional communication methods. At the Microfinance Center, collaboration is key, and together with our 14 partners, we are making a more substantial impact in promoting responsible borrowing practices.

Campaign Partners 2024:

- Prima Finantare, Moldova

- Microinvest. Moldova

- Vitas, Romania

- Partner, Bosnia and Herzegovina

- Fondi Besa, Albania

- Mi-Bospo, Bosnia and Herzegovina

- AMFI, Bosnia and Herzegovina

- FED Invest, Albania

- EKI, Bosnia and Herzegovina

- IUTE, Albania

- NOA, Albania

- Microsmart, Greece

- Horizonti, Macedonia

- Moznosti, Macedonia

- Agro & Social Fund, Albania

- The Albanian Microfinance Association, Albania

- Kredo, Albania

Celebrating the Resounding Success of the 26th MFC Annual Conference Through Remarkable Images

The Microfinance Centre (MFC) is proud to announce the resounding success of the 26th MFC Annual Conference Embracing Diversity for Inclusive Finance. Held on May 14-15, 2024, in Cracow, Poland, the event gathered approximately 400+ participants from 39 countries, creating a dynamic atmosphere for insightful dialogue and networking.

The conference attracted the microfinance providers from 127 microfinance and social enterprise finance providers, 12 microfinance national associations, 28 investors, 13 consultancies, 9 policymakers and regulators, and 5 IT & digital services providers.

Attendees highlighted key aspects of the event: 64% valued meeting potential business partners, 61% found the sessions highly informative, and 71% appreciated the relevance of the sessions to their work and the professionalism of the speakers. Furthermore, 89% of participants felt they had ample time to engage with other participants, leading to numerous significant connections and discussions (*).

The conference featured a diverse array of sessions addressing pressing issues in microfinance. Participants engaged in thought-provoking conversations led by industry experts and thought leaders, exploring topics such as pathways to inclusive finance, innovative approaches to climate change, leveraging technology for greater financial inclusion, ESG reporting as a catalyst for microfinance transformation and the intersection of finance and social impact. Sessions underscored microfinance’s role in empowering vulnerable entrepreneurs, navigating trends in inclusive finance, and harnessing artificial intelligence for diverse and inclusive microfinance.

The Microfinance Center had privilege of hosting distinguished speakers and moderators, including Cristina Dumitrescu from European Investment Fund (Luxembourg), Surjit Chana from Beneficial State Bank (United States), Florian Ott from Erste Group Bank AG (Germany), Elvina Garayeva from Incofin Investment Management (Belgium), Brigitte Fellahi-Brognaux from European Commission, DG EMPL (Belgium), and many more esteemed experts (the full list of speakers is on: www.2024mfc.org). Their insightful presentations and expertise greatly enriched the conference.

During the conference, MFC hosted a landmark roundtable with representatives from the National Banks of Armenia, Georgia, Kyrgyzstan, Tajikistan, and Uzbekistan, alongside delegates from the Asian Development Bank (ADB) and International Finance Corporation (IFC). Participants deliberated on strategies to promote sustainable growth in the microfinance industry, with a focus on financial stability and consumer protection. Regulators discussed addressing challenges within their respective countries, while ADB and IFC representatives shared their extensive experiences, offering valuable advice on regulatory frameworks.

The roundtable concluded with a commitment to ongoing knowledge sharing and policy discussions aimed at fostering a supportive regulatory environment. A subsequent networking lunch furthered opportunities for dialogue and collaboration, including additional representatives from Bosnia and Herzegovina, Kosovo, and national microfinance associations.

The MFC Annual Conference provides a unique opportunity to establish new partnerships between funders and social finance providers. Each year, we are happy to welcome new stakeholders joining the MFC family – remarked Archil Bakuradze, MFC Council Chairman and Chair of the Supervisory Board at JSC MFO Crystal, Georgia.

Ewa Bańkowska, MFC Deputy Director emphasized: The microfinance sector continues to diversify by welcoming new types of financial providers, funders, but most importantly by expanding the outreach to vulnerable groups such as migrants or social enterprises. The diverse and dynamic interactions during the conference underscored the importance of embracing diversity to achieve financial inclusivity.

The conference was generously supported by sponsors: European Investment Fund (EIF), responsAbility Investments AG, Bank Gospodarstwa Krajowego, BlueOrchard, Frankfurt School of Finance & Management, Finance in Motion, The European Fund for Southeast Europe (EFSE) and partners: Agents for Impact GmbH, Accion, Aspekt, Incofin, Triple Jump, Polish Bank Association, CGAP’s FinDev Gateway.

See more remarkable images from the Annual Conference

About Microfinance Centre (MFC):

The MFC is a social finance network that champions fairness, inclusion, equality, and responsible service. It unites over 130 organizations across 36 countries in Europe and Central Asia, collectively delivering responsible microfinance services to nearly 2,000,000 low-income clients. Together with our members – microfinance, financial cooperative systems, social finance banks, social investors, academic institutions, national and international support organizations and networks – we seek to make financial services work effectively for people, communities and the planet by embracing sustainability good practices and standards, sharing knowledge, advocacy and networking in the region of Europe and Central Asia.

END

Contact Information:

Joanna Sosnowska-Orynska, Communications Coordinator at MFC

Email: joanna.sosnowska@mfc.org.pl

(*) According to evaluation survey results

Watch SIFTA Webinar: AI powered solutions for SEFPs – Responsible AI, Machine Learning and Practical Use Cases for Microfinance and Social Finance Institutions

Our Experts

Andre Kravchenko – Senior Vice President of Business Development at HES FinTech

Andre Kravchenko is the Senior Vice President of Business Development at HES FinTech. In this role, Andre is responsible for the development of strategic partnerships in the financial services ecosystem, working with legacy and fintech lending institutions on driving digital transformation, innovation and financial inclusion, powered by AI and Machine Learning. Andre is also the Head of Fintech Capital Solutions Advisory at HES FinTech, bringing over a decade worth of debt and equity capital markets experience and extensive transactional track record in the impact investment space.

Gift Mahubo – Senior Director, Operations and Technology, Accion Advisory

Gift Mahubo manages the delivery of data-centered and tech-enabled services to our global partners. Gift joined Accion in 2011 and brings more than 20 years of experience working in the areas of technology, digital strategy, process automation and digital product implementation. Prior to joining the organization, he served as Chief Information Officer for Accion partner Accion Microfinance Bank. Gift holds an MBA from National University of Science and Technology, Zimbabwe and a degree in electronic engineering, and is certified in IT governance, information security, auditing, compliance and project management.

Mark Rudak – Machine Learning Product Owner, GiniMachine

Mark Rudak holds the position of Machine Learning Product Owner at HES Fintech, where he plays a key role in the planning and development of a cutting-edge machine learning-based platform – GiniMachine, a no-code AI solution for Data Driven Decisioning.

With a deep understanding of the industry landscape, Mark is a driving force behind the transition towards responsible deployment of AI and strategic utilization of alternative data sources.

Our partners

Watch SIFTA Webinar: How to analyze social enterprises – Demystifying Financing Social Enterprise: Analysis, Risks & Rewards

Our Experts

Teresa Zagrodzka – senior expert in the field of financing social enterprises as well as being a professional advisor and trainer for the NGOs sector.

She headed the Social Economy department in TISE – Polish microfinance institution which implemented pilot program: preferential loans for social enterprises in Poland, then continued with the developed financial instruments for these entities also in other countries: Slovakia, Slovenia, Croatia, Hungary. As an expert, trainer and adviser she participated in the project creating the social enterprises’ support ecosystem in North Macedonia in terms of reinforcement already existing entities, encouraging potential partners to finance them (including loans, donations, contracts).

In the role of MB member or financial director she was and still is in charge of finance management in few organizations that run economic activity.

She wrote many articles and publications on finance management, basic accountancy for non-accountants, dedicated to NGO managers. She is also co-author of manual on an innovative social impact bonds concept, report on financial sources for innovative projects in Poland or several reports on the Macedonian social entrepreneurship needs, condition and development directions.

Beata Biela – Advocacy Manager.

Beata has professional experience both in social economy sector and in business entities. She worked in TISE within social economy division both in grating loans to social economy entities and in Social Venture Capital. Before that she worked in Caritas Somalia in Africa, at Finance Commission of Caritas Internationalis in Rome, PAH. In the past, she worked in business entities like PKN Orlen (capital investments), PKP (capital group controlling), Pfeifer&Langen – previously BSO Polska (controlling and business development), Ernst&Young (due diligence, corporate finance, audit). She graduated from Warsaw School of Economics in the line of Finance and Banking as well as Management and Marketing. She also completed postgraduate studies of Geopolitics and Geostrategy, Global Development, MBA. She is a CFA charterholder.

Our partners

Watch SIFTA Webinar: How to give employees constructive feedback

Our Experts

Bożena Olszewska, Servant Leadership trainer, coach and emphatic communication trainer

Bożena for over 15 years has been practicing the use of modern forms of education such as coaching, career counselling, Career Compass and behavioral style profiling.

She supports people and organizations in following and discovering direction and empowering strategies that flow from their values and needs.

Throughout her career, she has been in charge of distribution, developing contractor networks and sourcing new markets in Europe, Asia and the USA. At the same time, she led groups and teams in non profit organizations. She also supports artistic communities, aimed at the personal development of artists.

Our partners

FEBEA and MFC Join Forces to Strengthen Microfinance and Ethical Finance in Europe

Setting up financial instruments supporting migrant integration.

Watch Webinar: MFC and Tech to the Rescue

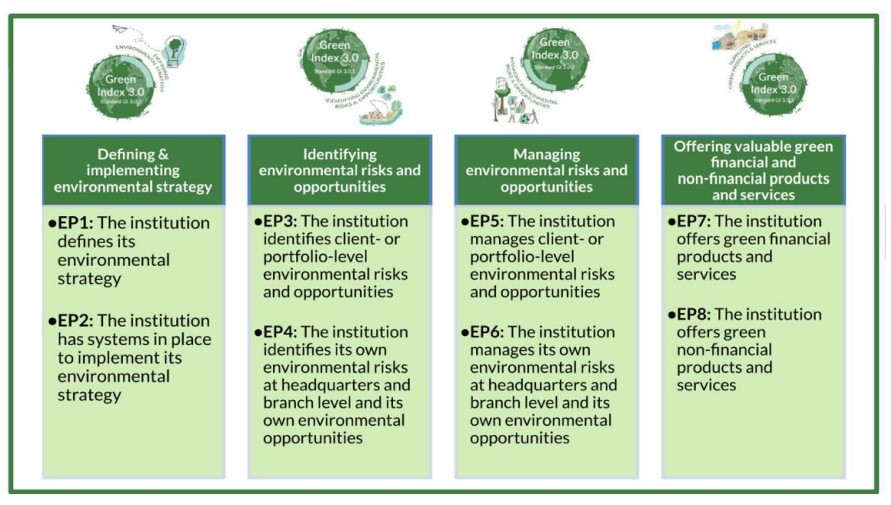

Green Index 3.0: case studies for each Essential Practice

Join the webinar: Digital self-service platforms for vulnerable clients. Improving green and digital skills

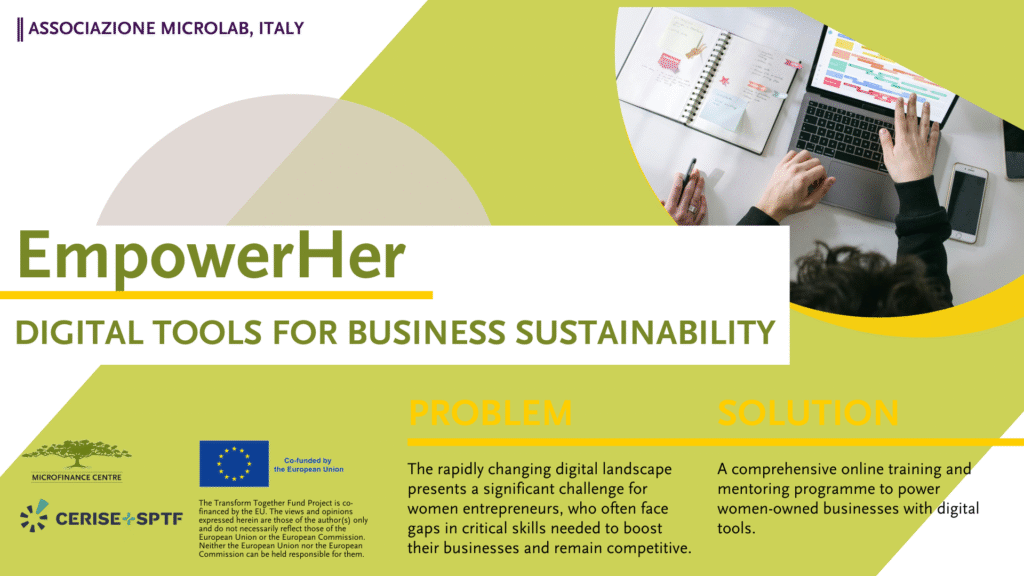

Join us for a practical webinar focused on how digital self-service platforms are transforming the way microfinance clients can develop green and digital skills. This session will spotlight 3 innovative projects implemented by Filbo (Romania), Adie (France), and Microlab (Italy), which are part of the Transform Together Fund Project, co-financed by the ESF+ Programme. Throughout the last 15 months, the organizations were working on the solutions that have measurable impact on client’s skills and inclusion.

You will meet Hermina, AI based chatbot developed by Filbo to help their clients implement green projects, financed by green loans. You will review Adie’s platform for urban entrepreneurs to help them choose green solutions for their businesses. Microlab will share on how they worked with women from different parts of Italy to help them gain skills they need to sell their products and services online.

We’ll begin with a brief introduction to the platforms and their purpose. Each organization will then present their approach, challenges in reaching clients, and the outcomes they’ve observed. You’ll gain a clear understanding of how these platforms operate and what makes them successful.

We will also reflect on what makes these projects stand out, how they compare to traditional teaching methods, what resources are needed to implement them, and what lessons have been learned.

Whether you are a practitioner, policymaker, or curious about best ways of improving client’s skills, this session will offer valuable insights and inspiration.

Speakers:

- Alexandra Grecu, Business Analyst, Filbo, Romania

- Timothy Donato, Project Manager, Microlab, Italy

- Vincent Buschi, Project Development Officer, Adie, France

- Moderator: Ewa Bańkowska, Deputy Director, MFC, Poland

Join the webinar: Improving green and digital skills of clients in rural areas through direct and online engagement

Join us for a practical webinar to explore how innovative approaches are helping rural clients and farmers across Europe build green and digital skills. You’ll hear firsthand experiences from 4 organizations that are part of the Transform Together Fund Project, co-financed by the ESF+ Programme. 3Bank (Serbia) will share their experience on how they enable digital signing of documents in loan process for small registered farmers. Coopfin (Italy) will present insights on how they help build digital marketing skills to improve women’s work quality in the rural areas of Sardinia Island. FAER (Romania) will present their lessons learnt from work with farmers on improving their soil management practices and FDPA (Poland) will discuss how they educate their beneficiaries in precision agriculture and digital marketing.

You’ll gain insights into the process, challenges, and successes — and have the opportunity to ask questions and get inspired to replicate these solutions in your own context.

- Ana Stameski, Digital Channels and Processes Director, 3Bank, Serbia

- Emanuele Cabras, President, COOPFIN, Italy

- Iulia Puscas, FAER, Romania

- Karolina Witeska-Chmielewska, Director of Rural Development and Promotion Department, FDPA, Poland

- Moderators: Cécile Lapenu, Executive Director, Cerise+SPTF, Fanny Le Maguet, Chief Operating Officer, Cerise+SPTF, Maxence Soulet, Environment & Agriculture Project Officer, France

EmpowerHer: check how to strengthen the women entrepreneurs digitally

Recap of Novalend Peer-to-Peer Visit to Klear Lending under SIFTA

Two days of sharp insight and no-fluff exchange wrapped up the SIFTA Peer-to-Peer visit, where NovaLend (Poland) met with Klear (Bulgaria) in Sofia on 17–18 June.

During the visit, participants focused on several key areas to facilitate mutual learning and the exchange of best practices:

- Digital strategies for client lifecycle management

- Credit risk management and decision-making processes

- Metrics and mitigation strategies for portfolio at risk

- Effective debt collection strategies and processes

The visit was extremely insightful and resulted in several key takeaways:

- Enhanced understanding of effective digital strategies for onboarding and managing clients

- Improved approaches to credit risk analysis and management

- Effective methods for mitigating risk within the lending portfolio

- Invaluable insights into debt collection processes and strategies

We would like to extend our heartfelt thanks to the participants who made this exchange possible:

- Sergii Demchuk, CEO – Novalend

- Arkadiusz Siwik, Head of Marketing – Novalend

- Alexey Melevich, Chief Business Development Officer – Novalend

Special thanks to Sergey Panteleev, Board Member and Boris Ilinov, Chief Financial Officer of Klear Lending, and Grzegorz Galusek, MFC Key Expert, for facilitating this visit and enabling such a productive exchange.

Stay tuned for more updates and insights from our collaboration under SIFTA Program!

BCR Social Finance Welcomes Bielskie Centrum Przedsiębiorczości (BCP)

The SIFTA Peer-to-Peer visit to BCR Social Finance in Bucharest, held on June 11-12, 2025, marked a significant step towards fostering collaboration and knowledge exchange in the realm of micro and social enterprise lending operations.

The primary objective of the visit was to facilitate a comprehensive knowledge exchange between BCP and BCR Social Finance. The focus was set on expanding micro and social enterprise lending operations, understanding best practices, and exploring potential areas of collaboration.

The participants engaged in several insightful discussions:

- Financial Products and Services

- Non-financial Programs

- Impact Measurement

- Challenges and Future Directions

- Operational Deep Dive

- Collaborative Opportunities

We thank all participants and organizers for their contribution:

- Anna Jędrusik – Member of the Management Board

- Katarzyna Kościelny – Member of the Management Board

- Marcin Sanetra – President of the Management Board (CEO)

- Mihai Dragnea, Head of Business Development

- Adrian Stefan Ciubuc, Business Development Coordinator

- Camelia Negru, Business Development Coordinator

- Grzegorz Galusek, MFC, SIFTA Senior Key Expert

The discussions and outcomes from the visit are expected to significantly contribute to the advancement of social finance initiatives and the development of sustainable and impactful financial practices.

The visit was organized under SIFTA program.

Register for webinars: 9 Practical Solutions to Boost Green & Digital Skills in Microfinance

Join Microfinance Centre and Cerise+SPTF for a hands-on webinar series under the Transform Together Fund, where practitioners will showcase the innovative projects they developed with grants of up to €50,000. These initiatives have been tested in real contexts and are already making a difference.

🔹 26 June | 11:00–12:30 (CET)

Digital self-service platforms for vulnerable clients. Improving green and digital skills

🔹 1 July | 11:00–12:30 (CET)

Improving green or digital skills of clients in rural areas through direct and online engagement

Nine inspiring organizations from across Europe will present practical solutions that empower microfinance clients – especially from vulnerable groups – to build their green and digital skills.

You’ll hear how the projects were implemented, what challenges were faced, and what impact they’re having on the ground.

Whether you’re a practitioner, policymaker, or advocate for inclusive finance, this series offers inspiration and actionable ideas you can apply in your organization.

Webinar Schedule

🔹 26 June | 11:00–12:30 (CET)

Digital self-service platforms for vulnerable clients. Improving green and digital skills

A practical webinar focused on how digital self-service platforms are transforming the way microfinance clients can develop green and digital skills. This session will spotlight 3 innovative projects implemented by Filbo (Romania), Adie (France) and Microlab (Italy).

You will meet Hermina, AI based chatbot developed by Filbo to help their clients implement green projects, financed by green loans. You will review Adie’s platform for urban entrepreneurs to help them choose green solutions for their businesses. Microlab will share on how they worked with women from different parts of Italy to help them gain skills they need to sell their products and services online.

We’ll begin with a brief introduction to the platforms and their purpose. Each organization will then present their approach, challenges in reaching clients and the outcomes they’ve observed. You’ll gain a clear understanding of how these platforms operate and what makes them successful.

We will also reflect on what makes these projects stand out, how they compare to traditional teaching methods, what resources are needed to implement them, and what lessons have been learned.

Whether you are a practitioner, policymaker, or curious about best ways of improving client’s skills, this session will offer valuable insights and inspiration.

Speakers:

- Alexandra Grecu, Business Analyst, Filbo, Romania

- Timothy Donato, Project Manager, Microlab, Italy

- Vincent Buschi, Project Development Officer, Adie, France

- Moderator: Ewa Bańkowska, Deputy Director, MFC, Poland

🔹 1 July | 11:00–12:30 (CET)

Improving green or digital skills of clients in rural areas through direct and online engagement

A practical webinar to explore how innovative approaches are helping rural clients and farmers across Europe build green and digital skills. You’ll hear firsthand experiences from 4 organizations: 3Bank (Serbia) will share their experience on how they enable digital signing of documents in loan process for small registered farmers. Coopfin (Italy) will present insights on how they help build digital marketing skills to improve women’s work quality in the rural areas of Sardinia Island. FAER (Romania) will present their lessons learnt from work with farmers on improving their soil management practices and FDPA (Poland) will discuss how they educate their beneficiaries in precision agriculture and digital marketing.

You’ll gain insights into the process, challenges, and successes — and have the opportunity to ask questions and get inspired to replicate these solutions in your own context.

- Ana Stameski, Digital Channels and Processes Director, 3Bank, Serbia

- Emanuele Cabras, Director, COOPFIN, Italy

- Iulia Puscas, FAER, Romania

- Karolina Witeska-Chmielewska, Director of Rural Development and Promotion Department, FDPA, Poland

- Moderators: Cécile Lapenu, Executive Director, Cerise+SPTF, Fanny Le Maguet, Chief Operating Officer, Cerise+SPTF, Maxence Soulet, Environment & Agriculture Project Officer, France

More on Transform Together Fund

Why ESG factors are important for the business sector, particularly for credit unions?

We discussed the importance of ESG factors for credit unions during the SIFTA workshop “ESG Overview and Implementation” on June 9th, 2025, at WESPA Spaces, Zagreb which Microfinance organized in partnership with the Croatian Association of Credit Unions (HUKU).

The workshop also covered the development of the ESG concept, climate change, regulatory frameworks and sector-specific topics, providing practical guidelines and examples of best practices.

We appreciate the active participation and engagement, and we look forward to continuing our efforts in promoting sustainability and responsible business practices.

We extend our heartfelt thanks to all the participants and credit union employees who attended. Special gratitude goes to Ms. Ana Matić, HUKU Secretary and Ms. Nataša Novaković, our esteemed expert, Director for ESG at the Croatian Employers’ Association, for her invaluable insights and contributions.

#ESG #Sustainability #CreditUnions #HUKU #MFC #SIFTA #WorkshopSuccess

How to lead and connect the talents and needs of multiple generations? Join our SIFTA webinar on managing a multi-generational team

Our Experts

Aneta Montano – Trainer

Aneta is a seasoned leadership and training professional with extensive experience supporting global organizations in building high-performing, multicultural, and multigenerational teams. She has delivered leadership and development programs for prominent clients including Santander Consumer Bank, British American Tobacco, Herbalife, ING Bank, and DKMS.

Her leadership journey spans more than two decades across North America and Europe. While based in the United States, Aneta led numerous diverse teams. Her ability to foster inclusion and adapt her leadership style to individual, generational, and cultural needs consistently translated into exceptional business outcomes. Under her direction, her team ranked among the highest in customer satisfaction across the region.

Aneta further developed her international leadership credentials as Market Manager for Poland with a major retail brand, and later as Vice President at FCM Travel Solutions—a global brand under the Flight Centre Travel Group (FCTG), one of the world’s largest travel companies. In her VP role, she was responsible for strengthening cross-border collaboration, improving transparency in client relationships, and aligning teams across European markets and global structures.

Fluent in the language of cultural nuance and organizational performance, Aneta brings a uniquely global perspective to her work. She is married to a Bolivian, has lived and worked in the United States for over a decade, and has held leadership roles in organizations based in the US and Estonia. Currently residing in Poland and spending part of the year in Spain, she continues to deliver impactful learning experiences that bridge cultures, generations, and business goals—for both organizations and students.

Our partners

SIFTA | Webinar on Beyond Compliance: Operationalizing ESG for a Sustainable Competitive Edge

Our Experts

Dr Agyeya Tripathi, Deputy Director – Consulting, Agents for Impact

Dr Agyeya Tripathi leads ESG strategy and consulting at Agents for Impact, where he supports financial institutions globally in building sustainability roadmaps, ESG policies, and capacity. He has worked across Asia, Europe, Africa and Pacific countries with a focus on inclusive finance, sustainability ratings, and SDG alignment.

Pratibha Singh, Deputy Director – Sustainability Rating, Agents for Impact

Pratibha Singh has dedicated close to a decade of her career working with NGOs, think tanks and associations in India, Thailand and Germany on issues such as gender equality, climate change, migration, conflict management and sustainable development. Adept in content creation & storytelling, she has published around 40 articles, book chapters, issue briefs and papers. She holds two Masters degrees in Gender & Development Studies & Public Policy. Currently, she aims to maximise positive impact of financial institutions in consonance with Agenda 2030 at Agents for Impact where she is working as Deputy Director-Sustainability Ratings. Simultaneously, she is pursuing her PhD from EBS University of Business and Law on sustainability transitions in small-and medium sized cities of the Global South.

Our partners