Tag: Research

Research

Over-indebtedness of microfinance clients

Since 2008, MFC has studied drivers and deterrents of client over-indebtedness through annual MFI mapping studies and targeted country studies [...]

Read more ...

Past Projects

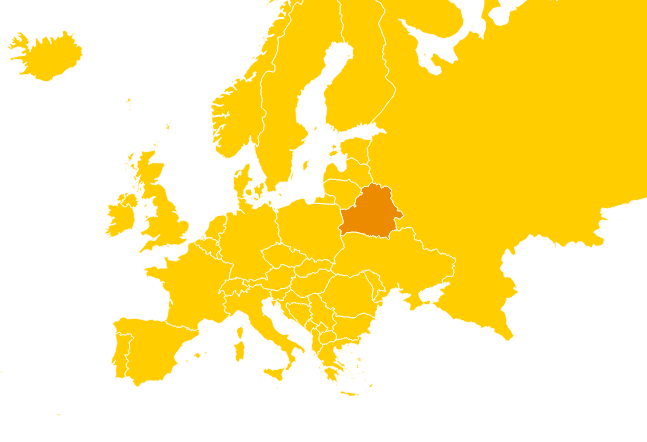

Measuring Access to Finance: Developing Evidence-Based Access Policies in Belarus

The project was initiated and managed by the ent agencies and funded by [...]

Read more ...

Past Projects

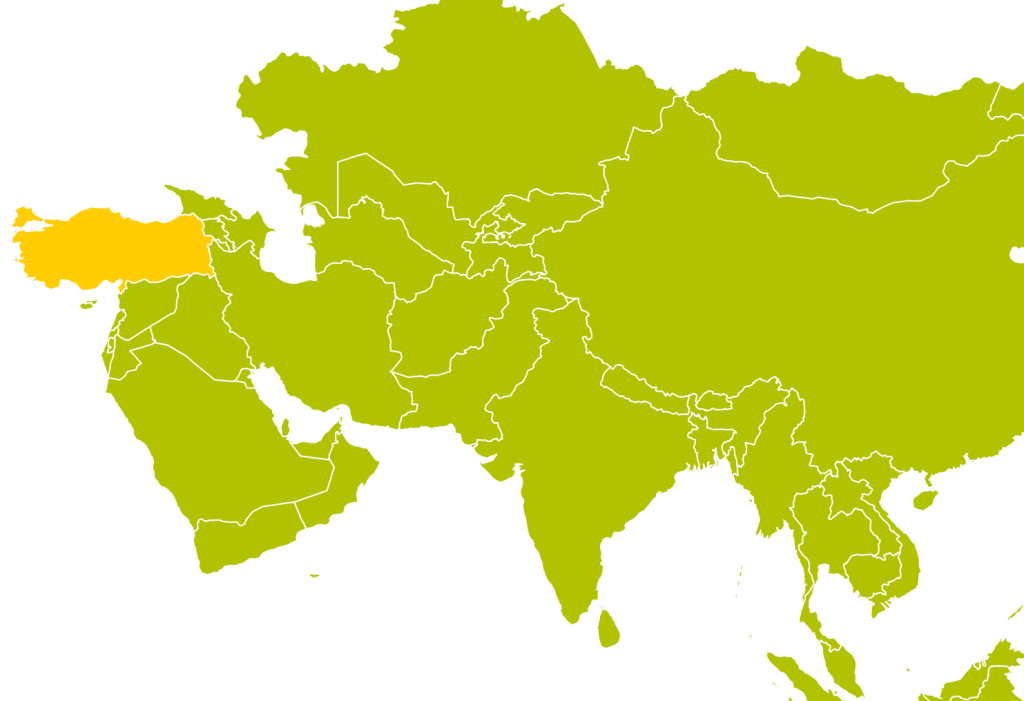

Overview of the State of Financial Inclusion in Turkey

The project entitled: “Overview of the state of financial inclusion in Turkey” [...]

Read more ...

Past Projects

Measuring Access to Finance: Developing Evidence-Based Access Policies in Poland

[...]

Read more ...

Library

Financial Inclusion of Individuals in Poland

[...]

Read more ...

Library

Measuring Financial Inclusion in the EU: the New “Financial Inclusion Score”, 2014

[...]

Read more ...

Library

Measuring Financial Inclusion in Turkey

The briefing [...]

Read more ...

Library

The Level of Indebtedness of MSME Credit Customers and the Quality of Finance in Bosnia and Herzegovina

The [...]

Read more ...

Library

Measuring Access to Finance: Developing Evidence-Based Access Policies, 2012

Measuring Access to Finance: Developing Evidence-Based Access Policies Access to Finance Scorecard (AFS) framework captures diverse aspects of access and [...]

Read more ...

MFC Research Results

MFC Research Results and Publications 2009-2012

[...]

Read more ...