Tag: Research

Delivering Financial Capability: A Look at Business Approaches

Financial capability has been a buzz word for almost a decade as more and more financial institutions and other stakeholders [...]

Read more ...

Financing Gap and SME Employment Growth: Beyond Access to Finance

The key aim of these MFC research paper [...]

Read more ...

“Indicators to monitor over-indebtedness” working paper launched by the EFIN Working Group

The The work on this publication has received financial support from the European Union Programme for Employment and Social Innovation [...]

Read more ...

Microfinance in Europe: A Survey of EMN-MFC Members. Report 2014-2015

This seventh edition of [...]

Read more ...

Webinar: Microfinance in Europe: Key Results from the EMN-MFC Survey Report 2014-2015!

[...]

Read more ...

Research. Archive: 2003-2008

[...]

Read more ...

Research Program

MFC undertakes quantitative and qualitative research studies in order to provide an insight into the drivers of customer behavior and [...]

Read more ...

Demand for Microfinance Services

We conduct studies to assess the need for credit, deposit and microinsurance services among clients and develop market development projections [...]

Read more ...

Access to Finance

[...]

Read more ...

Supply for Microfinance Services

We use surveys and in-depth interviews to explore issues around infrastructure, product availability, and legal/regulatory opportunities and constraints around the [...]

Read more ...

Microinsurance

MFC connects microfinance providers with regulated insurance companies to improve and expand clients’ access to quality microinsurance products The three-year [...]

Read more ...

Entrepreneurship and value chains

Our research into entrepreneurship and value chains helps us to understand the factors enabling poverty reduction and growth in region [...]

Read more ...

Financial Health

Financial health is the condition in which a household effectively manages its income and expenses, is resilient to financial shocks [...]

Read more ...

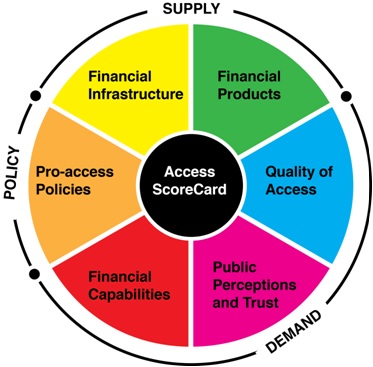

Access to Finance Barometer

As part of a multi-component project funded by European Commission, MFC is developing and testing methodology of Access to Finance [...]

Read more ...

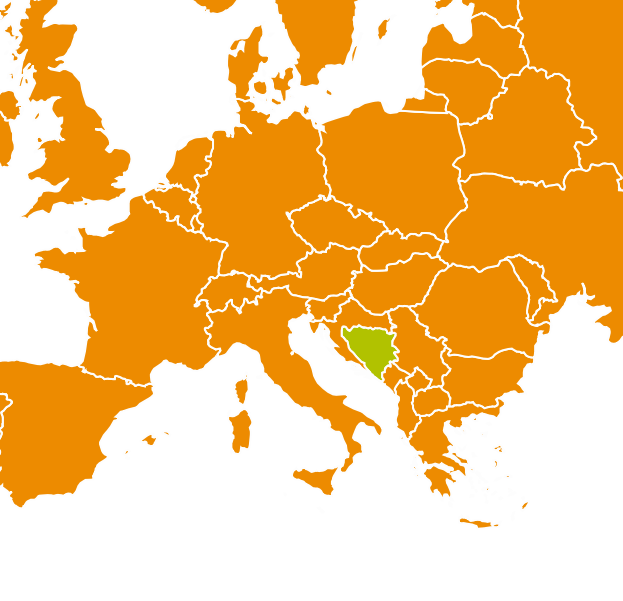

Bosnia and Herzegovina: Follow-up study on the risk of over-indebtedness of microcredit clients

[...]

Read more ...

Bosnia and Herzegovina: Pilot study on access of low-income households to financial services

This study examined the application of customer protection principles, access to financial services and [...]

Read more ...

Kosovo: Study on the risk of over-indebtedness

This study sought to understand whether there is a problem of (over-)indebtedness among [...]

Read more ...

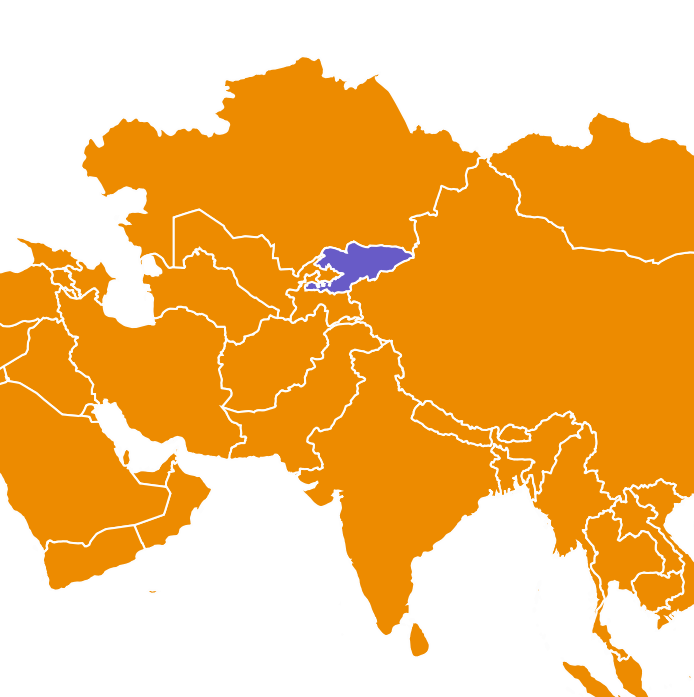

Kyrgyzstan: Research on indebtedness and repayment performance

In this study, MFC analyzed data from the CIB “Ishenim” credit bureau, which manages borrower information [...]

Read more ...

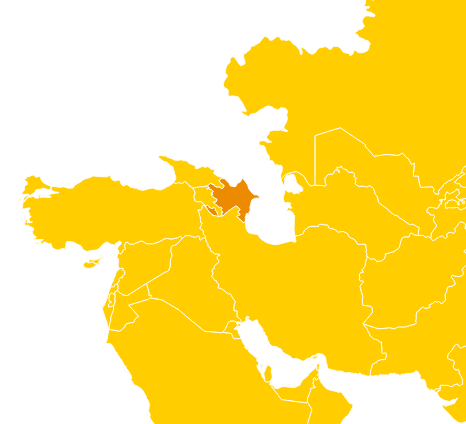

Azerbaijan: Study on the risk of over-indebtedness of microcredit clients

This study on the risk of over-indebtedness in the ECA region was carried out in partnership with [...]

Read more ...

European Union: Measuring Over-indebtedness: Indicators, Data, Reporting

[...]

Read more ...