Category: Past Projects

Digtal Literacy Bootcamp

Being present online is a must for microfinance institutions. However, a big question is how to do it effectively to [...]

Read more ...

Digital Bootcamp Labs

[...]

Read more ...

Digital Literacy Bootcamp – На русском

#DigLitBootcamp это онлайн-курс направлен на создание прочной основы для процессов цифровой [...]

Read more ...

4th European Microfinance Day: E=mc2

is initiative has received financial support from the European Union Programme for Employment and Social Innovation “EaSI” (2014-2020). For further [...]

Read more ...

Building Financial Capabilities and Strengthening Institutions through Customer-Centered Innovations

Project partners taking part in first phase: [...]

Read more ...

MFC-EMN Annual Conference 2018

is initiative has received financial support from the European Union Programme for Employment and Social Innovation “EaSI” (2014-2020). For further [...]

Read more ...

Alternative Finance Forum: Fin-tech, Social finance & more

[...]

Read more ...

Migrant Acceleration for Growth Network

There is a growing body of evidence that (aspiring) migrant entrepreneurs require a different set of core competences to successfully [...]

Read more ...

Financial education for all!

[...]

Read more ...

SP Fund round 3 in numbers

[...]

Read more ...

Financial education in Belarus: Helping over 2,000 people gain new skills!

We are pleased to announce the results of our three-year financial education project conducted in cooperation with [...]

Read more ...

Increasing Access to Finance for Rural Population in Belarus

[...]

Read more ...

Financing start-ups and social outcomes measurement

This initiative is supported by [...]

Read more ...

CEO Summit 2016: From crisis management to strategic foresight

The discussion on future trends was led by Dr. Cornelia Daheim (Future Insights), who introduced the concept of strategic foresight [...]

Read more ...

Reaching delinquent youth through “My home, my responsibility”

[...]

Read more ...

Strategic Advice for Launching a Financial Literacy Center in Kosovo

[...]

Read more ...

My Home, My Responsibility

Funder: The project is supported by Obywatele dla Demokracji Program, finansed by EOG grants [...]

Read more ...

Promoting Women’s Entrepreneurship in Rural Azerbaijan

[...]

Read more ...

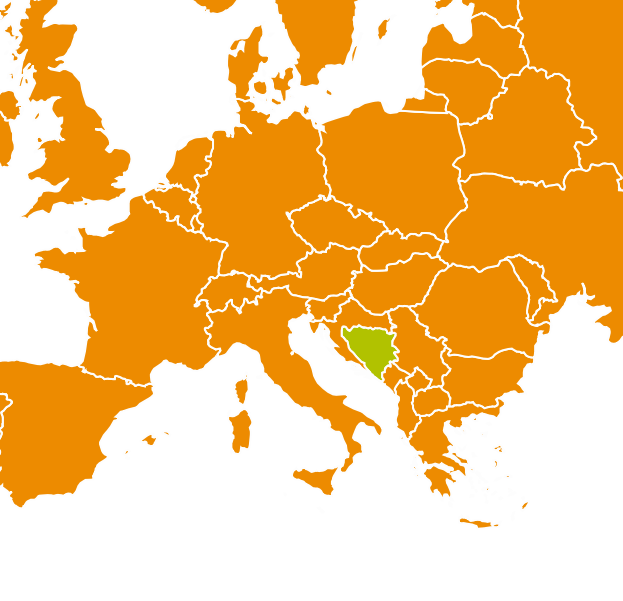

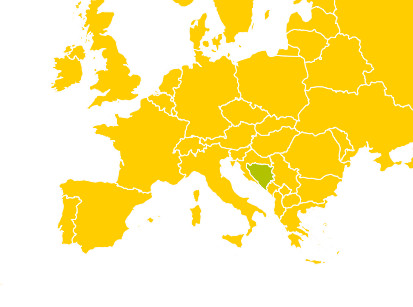

Bosnia and Herzegovina: Follow-up study on the risk of over-indebtedness of microcredit clients

[...]

Read more ...

Bosnia and Herzegovina: Pilot study on access of low-income households to financial services

This study examined the application of customer protection principles, access to financial services and [...]

Read more ...Projects

Welcome to our Projects Page, your gateway to exploring impactful initiatives in digitalization, social economy, responsible finance, green microfinance, and other projects. Immerse yourself in stories of innovation that collectively shape the future of microfinance. Discover a diverse range of projects contributing to positive change and progress.